Advertisement|Remove ads.

Miniso Stock Rises On JPMorgan Upgrade Citing Growth In Overseas Markets, But Retail’s Still Bearish

U.S.-listed shares of Miniso rose 1.09% in after-hours trading on Monday after the company received a rating upgrade from JPMorgan following its fourth-quarter earnings, but retail sentiment stayed downbeat.

JPMorgan upgraded Miniso to ‘Overweight’ from ‘Neutral’ with a price target of $22, up from $15.

The Fly reported that JPMorgan expects Miniso's same-store-sales growth for China to rebound, additional margin improvements and a "robust" overseas expansion.

Miniso’s overseas markets fared strongly with year-over-year revenue growth coming in at 41.9% for the full year 2024 with the growth of the brand overseas.

The analyst also noted Miniso’s expectations of seeing faster revenue growth than 2024 in all its units, the report added, citing the analyst.

Miniso’s shares have slumped 24% year-to-date due to market concerns and China’s performance, the analyst noted.

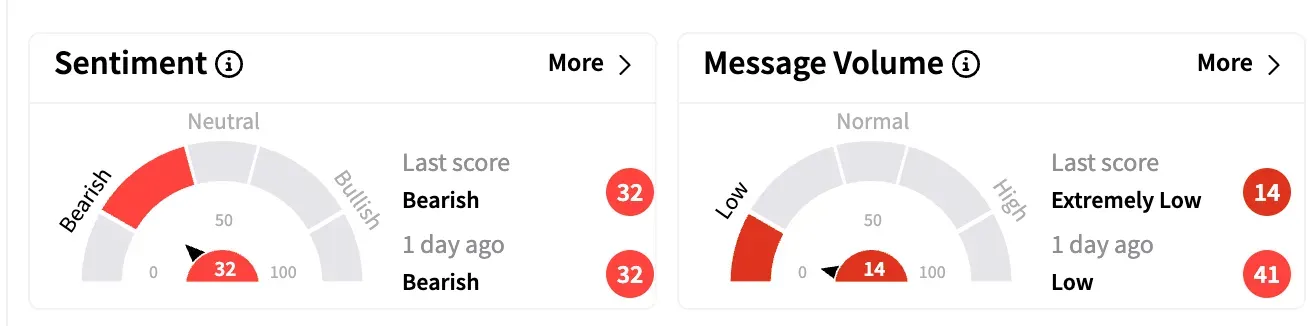

Retail sentiment on Stocktwits ended on a 'bearish' note on Monday, while message volume fell in the ‘extremely low’ zone.

For its Q4, the company posted earnings per share of $0.36, beating the estimated $0.33. Its revenue came in at $650.1 million, 2.4% lower than the expected estimate.

Miniso’s board announced a cash dividend of $0.33 per American Depositary Share or $0.0817 per ordinary share during its latest earnings.

Miniso shares are down 20% year-to-date.

For updates and corrections email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)