Advertisement|Remove ads.

Why Small-Cap Mira Pharma's Retail Following Has Tripled From Last Week

Small-cap biotech Mira Pharmaceuticals (MIRA) has experienced a meteoric rise and subsequent plunge, captivating retail investors in the process.

The company's stock surged a staggering 627% on Monday following promising preclinical data for its novel oral ketamine analog, Ketamir-2. This dramatic increase sparked a frenzy of interest, with the number of Stocktwits followers surging over 212% in just one week.

Ketamir-2 has shown potential as a treatment for neurological and neuropsychiatric disorders, according to media reports. Unlike traditional ketamine, it exhibits better oral bioavailability and appears to have a reduced risk of side effects. These advantages could position Mira as a significant player in the development of novel therapies.

The company is also preparing to submit an Investigational New Drug (IND) application to the FDA by the end of this year.

However, the euphoria was short-lived. The stock plummeted over 54% on Tuesday, prompting some to take profits while they still had them.

Although some investors believe this represents a buying opportunity, others remain cautious, citing the long road to commercialization and the potential for future volatility.

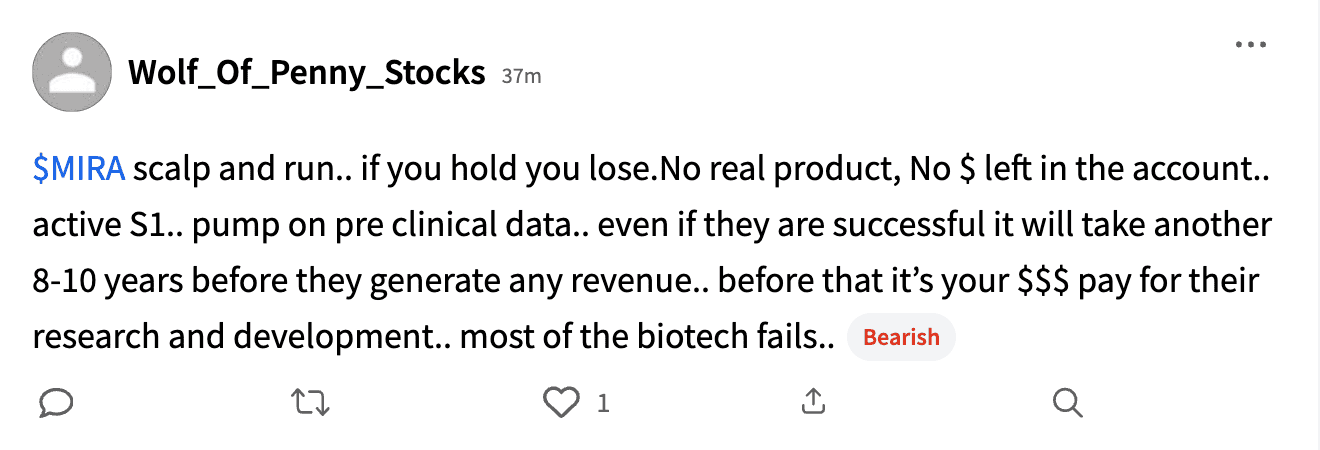

The Stocktwits stream had plenty of bearish posts, like the one from “Wolf_of_penny_stocks”, advising investors to “scalp and run” as Monday’s stock move was a “pump on preclinical data… even if they are successful it will take another 8-10 years before they generate any revenue.”

The rapid rise and fall of Mira Pharmaceuticals highlights the speculative nature of the biotech sector. While preclinical data is undoubtedly encouraging, investors must approach such volatile stocks with caution and conduct thorough due diligence before making investment decisions, as many posts on MIRA’s Stocktwits stream suggest.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)