Advertisement|Remove ads.

Moderna Stock Slips On Report Of CEO Relinquishing Sales Chief Role: Retail Mood Dims

Shares of Moderna, Inc. ($MRNA), among the frontrunners in mRNA vaccine technology, fell on Tuesday, bucking the broader market strength.

The weakness came after Bloomberg reported, citing a person familiar with the matter, that Moderna CEO Stephane Bancel is stepping down as chief commercial officer.

He will reportedly be replaced in the role by President Stephen Hoge, who will also assume responsibility for medical and research affairs.

The report comes just ahead of Moderna's earnings, which has been scheduled for Thursday. Analysts, on average, expect the company to report a loss of $1.94 per share and revenue of $1.25 billion.

Cambridge, Massachusetts-based Moderna shot to prominence with its COVID-19 vaccine Spikevax, which received emergency use authorization in Dec. 2020. The vaccine obtained FDA’s full approval in Jan. 2022.

COVID-19 vaccine sales helped the company to boost its top line from $803 million in 2020 to $18.47 billion in 2021.

Revenue grew slightly to $19.26 billion in 2022 before slumping to $6.85 billion in 2023 as COVID-19-related demand waned amid a plunge in infections. It reversed from a profit of $20.12 per share in 2022 to a loss of $12.33 per share in 2023.

Moderna is not a one-trick pony. The company has an FDA-approved respiratory syncytial vaccine meant for older adults. The company has a rich pipeline targeting various diseases ranging from flu to HIV to cancer in various stages of development

In September, the biopharma said it is seeking to reduce R&D expenses for 2025-2028 by about 20% over the next three years, and it also pushed forward its goals to achieve profitability by two years to 2028.

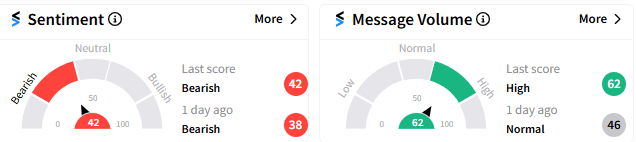

Retail mood on Stocktwits for MRNA turned sour, flipping into ‘bearish’ levels (42/100) from ‘bullish’ a week ago, amid an uptick in message volume.

As of 1:49 pm ET, Moderna stock was down 1.27% at $52.86.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)