Advertisement|Remove ads.

Morgan Stanley Sees Chipotle As A ‘Quality, Large-Cap Growth Compounder’ — Retail Traders Already Agree

Shares of Chipotle Mexican Grill Inc. (CMG) rose nearly 1% after the fast-food chain received an analyst upgrade, and retail sentiment remained upbeat.

Morgan Stanley upgraded Chipotle to 'overweight' from 'equal weight' with a price target of $70, increased from $65.

According to the research firm, Chipotle is a "quality large-cap growth compounder" with a flat stock price relative to 12 months ago.

Additionally, the report noted its drivers of product, marketing, and throughput should still be effective in delivering a "decent" 2025 and beyond.

The stock has fallen due to weak sales data and growth stock pressures, creating an opportunity if viewed as only short-term headwinds, according to Morgan Stanley.

"Since mid-2024, upward estimate revisions have been lacking mainly due to portion investments, some food cost pressures, and moderating sales that have been more aligned with expectations. We should be past this period of margin pressures by mid-2025," the firm said in a note.

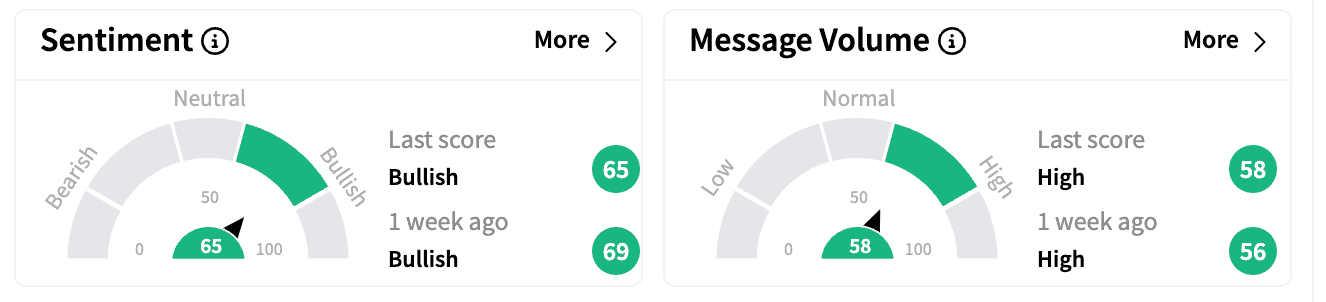

Sentiment on Stocktwits remained 'bullish' from a week ago. Message volume inched up in the 'high' zone.

One bullish commenter noted the company's assurance of 60bps impact from Trump tariffs, adding that "quality & size" are still winners despite a choppy consumer "vibe."

One bullish commenter noted the company's assurance of 60bps impact from Trump tariffs, adding that "quality & size" are still winners despite a choppy consumer "vibe."

"I think Chipotle sees $80 in a year," said another commenter.

Last week, Citi placed Chipotle on a "90-day positive catalyst watch" with a 'buy' rating on the shares and a $70 price target, The Fly reported.

Citi expects Chipotle's new honey chicken limited-time offer, due for launch in March, to be a positive traffic and sales catalyst for its brand, lifting shares as high-frequency data improves.

Chipotle posted better-than-expected fourth-quarter earnings recently, with its management playing down the potential impact of Trump tariffs.

Chipotle stock is down 10% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)