Advertisement|Remove ads.

We Asked Retail Traders How They’re Playing Trump’s Tariff Moves: Most See Opportunity Or Want To Wait It Out

The stock market weakness in February has spilled over into the new month as investors turn risk-averse amid multiple headwinds. President Donald Trump's policy moves on tariffs have triggered global recession worries and pushed traders to the defensive.

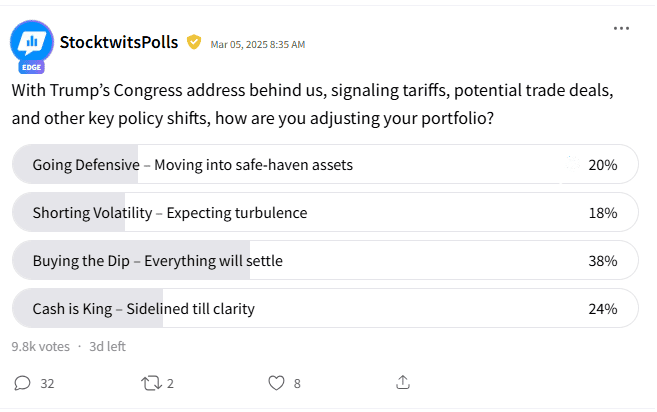

An ongoing Stocktwits poll probed users' investment stances in light of the policies announced by the president at his first address to a joint session of Congress late Tuesday.

The poll, which has drawn nearly 10,000 responses, showed that 38% looked ahead to buy the dip on the premise that things would settle down.

The remaining respondents said they were positioned for more pain. One-fifth (20%) preferred going defensive and shifting their investment dollars to safe-haven assets.

A more modest 18% see turbulence ahead but are willing to play out the downside by shorting the volatility.

Nearly a quarter (24%) of respondents chose to increase their cash holdings and stay on the sidelines, adhering to the "Cash is King" strategy until market conditions become clearer.

Trump agreed to defer implementation of tariffs on automakers that comply with the U.S.-Mexico-Canada (USMCA) trade agreement and for those Mexican ports that adhere to the agreement for a month.

Other policy measures include implementing reciprocal tariffs on countries imposing high duties on U.S. imports, beginning on April 2, tightening immigration norms, and beefing up border security.

The president also wants to push for additional tax cuts, the repeal of the CHIPS and Science Act, and deeper government spending cuts.

In a recent podcast, Morgan Stanley Global Head of Fixed Income Research Micahel Zezas said investors are confused about whether the U.S. policy choices are set to help or hurt the economy.

"Net-net, it's a lot of policy noise, and very little signal," he said.

The strategist said the fluid situation calls for investors to lean more toward the bond market. While the equity markets may hold up as investors look past the near-term costs, the risk of something going wrong with issues such as tariff escalation or broader geopolitical conflict may keep a ceiling on investors' risk appetite, he said.

Zezas opined that a growth slowdown clearly makes the case for owning bonds.

BMO Capital Markets economist Priscilla Thiagamoorthy said the term tariff appeared 50 times in the Beige Book report released this week, with contacts suggesting they will likely raise prices because of tariffs.

The economists said the report suggested the economy is slowing, and pricing pressures and trade uncertainty remain two key significant business concerns.

The U.S. index futures point to another session of jitteriness as investors await the release of the February non-farm payrolls report. After ADP's disappointing private payrolls report, traders will likely look for confirmation or a lack thereof from the Bureau of Labor Statistics report.

On Thursday, the Nasdaq Composite fell into correction territory. It remains to be seen if the tech sector launches a fightback, courtesy of Broadcom, Inc.'s (AVGO) earnings report.

The Invesco QQQ ETF (QQQ), an exchange-traded fund that tracks the Nasdaq 100 Index, ended Thursday's session down 2.75% at $488.20. The QQQ ETF is down 4.5% year-to-date.

For updates and corrections email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2197091542_jpg_880b7d0348.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Starlink_jpg_9ee1fff146.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244475103_jpg_13c45a71c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_ed6fc0a54f.webp)