Advertisement|Remove ads.

Most Stocktwits Users Expect S&P 500 To Climb Past 6,500 This Year Despite Macro, Fundamental Challenges

The S&P 500 Index, a measure of broader market performance, has seen a slow and steady recovery ever since it rebounded from its April 7 post-tariff lows.

The index ended last week at 5,976.97 as it pulled back over 1% on Friday after the University of Michigan’s June preliminary consumer sentiment reading surprised to the upside. The economy’s resilience despite the looming tariff threat dampened rate cut expectations, sending traders to the defensive,

The year began well for the market as traders began to bake in corporate-friendly policies from the incoming Donald Trump administration. Specifically, the Republicans’ promise of tax cuts and deregulation appealed to investors.

The S&P 500 Index reached an all-time high of 6,147.43 on Feb. 19. The upward momentum stalled amid profit taking before the Trump tariffs began taking a toll on the markets.

A steep sell-off following the “Liberation Day” tariff announcements in early April took the index to a low below the 5,000 level on April 7. Since then, it has made good its post-tariff losses and is up about 24% from the trough.

But it still trades off its Feb. 19 peak.

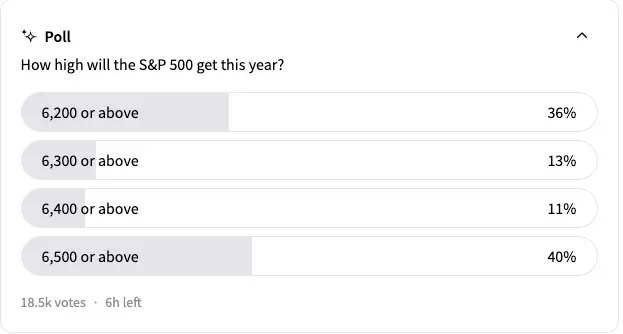

A Stocktwits poll that has received responses from over 18,000 users showed that most (40%) expected the S&P 500 Index to rise to 6,500 or above this year. At the lower end, this would mark a gain of 10.5% for 2025, on top of the 24% gain in the previous year.

A sizable proportion (36%) looks for more muted gains, expecting the index to hit 6,200-6,300 this year. Those predicting moves to 6,300-6,400 and 6,400-6,500 made up 13% and 11% of the total, respectively.

LPL Financial Chief Technical Strategist Adam Turnquist said technically, a close above 6,144 would validate a breakout to new highs.

“Bullish but not overbought momentum, relatively light investor positioning, and sanguine but not stretched investor sentiment all suggest this rally could have more room to run,” the strategist said.

He added that the return of cyclical leadership and broad participation since the April 8 closing low (4,982.77) provides additional technical evidence of a sustainable recovery.

Despite an improvement in the technical setup, fundamental and macro risks remain, Turnquist said.

The Invesco QQQ Trust (QQQ) ETF and the SPDR S&P 500 ETF (SPY) are up 3.20% and 2.17%, respectively, for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Ex-Fed Adviser Flags Israel-Iran Tensions As ‘Wild Card,’ Says Recession Odds Ticking Up

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)