Advertisement|Remove ads.

MicroStrategy Stock Tumbles Pre-Market As Bitcoin Continues To Slide: Retail Turns Bearish

Shares of MicroStrategy Inc. (MSTR) fell in pre-market trading on Monday after Bitcoin (BTC) prices continued to slide in the run-up to President-elect Donald Trump’s inauguration scheduled for Jan. 20.

MicroStrategy’s stock was down over 4.5% in pre-market trading, reflecting a downturn in Bitcoin prices, which declined more than 3% in the last 24 hours.

MicroStrategy, also known as Bitcoin proxy, had a rough last month in the markets – its stock has fallen nearly 20% in this period. At the same time, Bitcoin prices have remained relatively more resilient, falling less than 9%.

Despite losing a fifth of its value over the past month, MicroStrategy’s stock is still up more than 103% in the past six months.

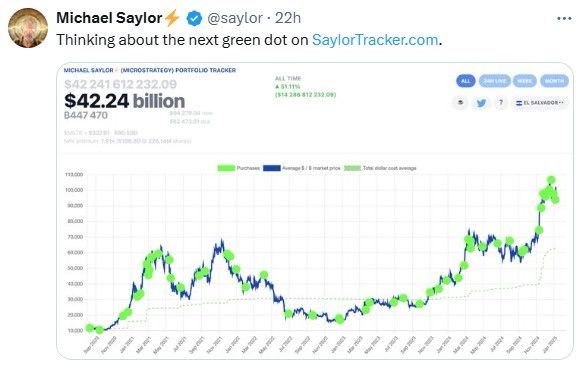

The company’s co-founder and executive chairman, Michael Saylor, is seemingly unfazed by the recent decline in both its stock and Bitcoin prices. Saylor posted the MSTR Bitcoin tracker for the 10th consecutive month, showing the performance of the company’s Bitcoin holdings, which is up by 51%.

As such, MicroStrategy is sitting atop unrealized gains of more than $14 billion.

Saylor’s Bitcoin tracker posts have come to hint at an impending purchase of the cryptocurrency. He even teased it, saying, “Thinking about the next green dot on SaylorTracker.com.”

Update: MicroStrategy announced the purchase of 2,530 Bitcoin for $243 million, at an average price of $95,972. Its current Bitcoin holdings stand at $41.17 billion, with 449,570 BTC in its kitty.

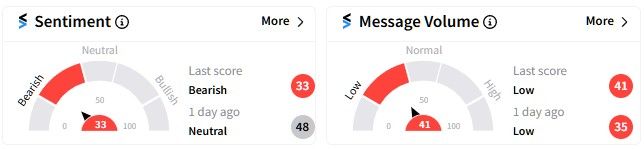

However, retail sentiment on Stocktwits soured, entering the ‘bearish’ (33/100) territory from ‘neutral’ (48/100) a day ago. Message volume rose to (41/100) from (35/100) in this period, increasing interest despite the bearish sentiments.

One user suggested there’s “growing distrust” in Saylor’s leadership.

Another user called the company “cyberspace Manhattan.”

One user predicted the next level for the MicroStrategy stock at $280, implying a downside of nearly 10%.

However, not everyone is sold on the bearish narrative – one user thinks shorts should not expect the current downtrend to continue.

MicroStrategy stock is up more than 103% over the past six months, but it is down nearly 40% from its all-time high of $542.99.

Bitcoin, on the other hand, is up nearly 58% over the past six months, but it is down nearly 16% from its all-time high of $108,268.45.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)