Advertisement|Remove ads.

Norwegian Cruise, Carnival Corp Stocks Rise On Citi’s Note: Retail Sails On Extremely Bullish Waters

Shares of Norwegian Cruise Line Holdings ($NCLH) and Carnival Corp. ($CCL) surged over 7% on Wednesday after Citi issued bullish notes on both stocks.

Citi upgraded Norwegian Cruise Line to ‘Buy’ from ‘Neutral,’ raising its price target from $20 to $30.

The brokerage’s analysis suggests the recent rally in cruise stocks “has real legs” into 2025 and beyond.

The analyst pointed to Norwegian’s strategic shift and pricing opportunity that isn’t expected to be offset by rising costs.

Citi predicts 23% annual earnings growth for Norwegian over the next three years, with potential upside to 30% if the company can sustain a 2.5% yield/cost spread, which would significantly boost earnings and drive multiple expansion.

Citi also raised its price target for Carnival to $28 from $25, reiterating a ‘Buy’ rating.

The brokerage cited Carnival’s land-based assets, like the upcoming Celebration Key private island destination in the Bahamas (set to open in July 2025), as key drivers of future yield growth.

Citi expects Carnival to offset slower sales growth by reducing debt and interest costs.

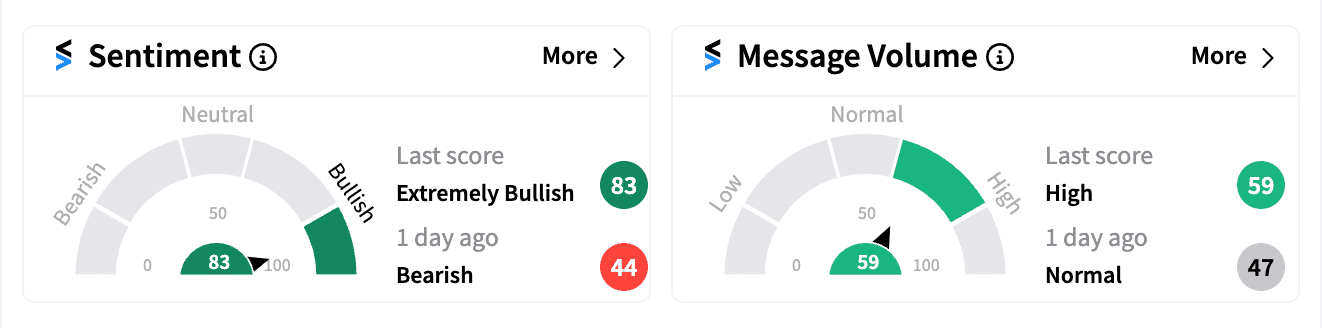

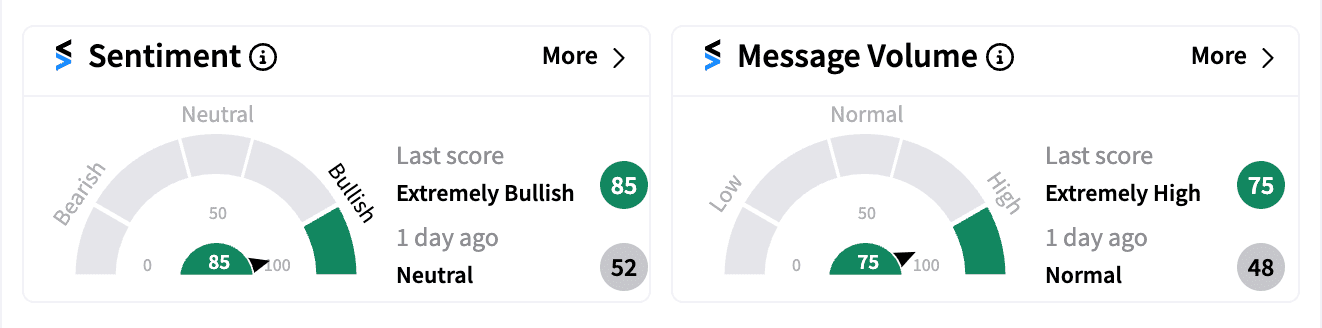

On Stocktwits, both CCL and NCLH were among the top ten trending tickers Wednesday afternoon, with retail sentiment turning ‘extremely bullish’ for both stocks.

Cruise stocks have been riding a wave of positive momentum, with Norwegian, Carnival, and peer Royal Caribbean Group ($RCL) recently reporting quarterly earnings that beat Wall Street expectations, fueled by strong demand.

Royal Caribbean CEO Jason Liberty has noted the shift in consumer spending toward experiences, with a particular focus on travel.

He added that baby boomers reaching retirement age are expected to grow 30% to 73 million by 2030, driving increased travel demand.

Liberty also pointed out that younger generations, including millennials, plan to allocate more of their time and money to travel compared to other leisure activities.

Year-to-date, Carnival stock is up 17%, while Norwegian has gained 25%, and Royal Caribbean has surged nearly 60%.

Read next: Pfizer Stokes Retail Curiosity As Stock Rises On Report Of CEO-Starboard Meeting

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212049822_jpg_4efc5f756c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)