Advertisement|Remove ads.

Newell Brands Stock Falls After Outlook, Q4 Revenue Falls Short, But Retail's Hopeful

Shares of Newell Brands Inc. (NWL) fell 24% on Friday after the company missed Q4 revenue estimates and lowered its outlook for fiscal 2025 and the first quarter, but retail sentiment remained optimistic.

Newell’s earnings per share beat Wall Street estimates at $0.16. But revenues came in at $1.95 billion, declining 6% year-over-year, compared with consensus estimates of about $1.96 billion.

Net loss narrowed to $54 million in Q4 compared with $86 million in the prior year period.

Newell Brands’s Learning and Development segment returned to positive annual sales growth, the company said, noting strong gross and operating margin improvement and increased its level of A&P investment.

"Newell Brands delivered strong results in 2024 driven by disciplined implementation of our new corporate strategy, operating model and culture transformation. We drove year-over-year sales performance improvement as we significantly strengthened the company’s front-end selling and marketing capabilities,” said Chris Peterson, Newell Brands’s President and CEO.

“While much work remains and the macroeconomic backdrop is still uncertain, we are laser-focused on returning the company to sustainable topline growth, continuing to drive operating margin improvement ahead of our evergreen target and strengthening the balance sheet."

Newell’s operating margin improved to 0.5% compared with negative 0.5% in the prior year period, the company said.

The company’s outlook for FY2025 now estimates normalized EPS to come in at $0.70 to $0.76. Net sales are expected to fall between 4% to 2%. For Q1, it expects normalized net loss per share between $0.09 to $0.06. Net sales are expected to decline between 8% to 5%.

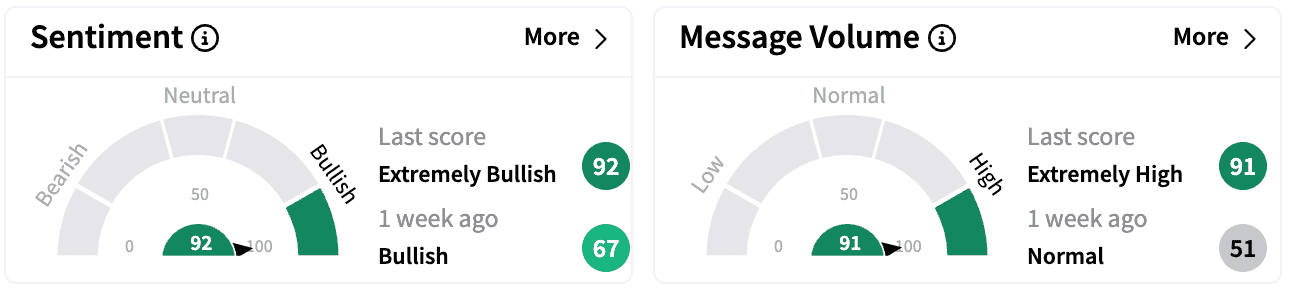

Sentiment on Stocktwits improved to ‘extremely bullish’ from ‘bullish.’ Message volumes were in the ‘extremely high’ zone compared with ‘normal.’

Newell’s brands include such names as Rubbermaid, Sharpie, Graco, Coleman, Rubbermaid and Commercial Products.

Newell stock is down 28% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2206289707_jpg_dd6dd89cfa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_roku_resized_jpg_3a7372ac07.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)