Advertisement|Remove ads.

NextEra Energy Stock Charges Up After Better-Than-Expected Q3 Profit: Retail Feels Exuberant

NextEra Energy on Wednesday reported mixed third-quarter results that saw earnings top Wall Street estimates but revenue fall short of estimates. Shares of the firm were trading over 2% higher on Wednesday morning.

The energy company reported adjusted earnings per share (EPS) of $1.03 compared to an estimate of $0.98. However, revenue came in at $7.57 billion, versus an estimate of $8.10 billion.

The firm’s subsidiary FPL’s net income grew to $1.293 billion compared to $1.183 billion in the same quarter a year ago.

NextEra Energy CEO John Ketchum said for the second consecutive quarter, NextEra Energy Resources added approximately 3 gigawatts of new renewables and storage projects to its backlog.

“We will be disappointed if we are not able to deliver financial results at or near the top of our adjusted earnings per share expectations ranges each year through 2027, while maintaining our strong balance sheet and credit ratings,” he said.

For 2024, NextEra Energy continues to expect adjusted earnings per share to be in the range of $3.23 to $3.43.

Meanwhile, for 2025, 2026 and 2027, NextEra Energy expects adjusted earnings per share to be in the ranges of $3.45 to $3.70, $3.63 to $4.00 and $3.85 to $4.32, respectively. The firm expects to grow its dividends per share at a roughly 10% rate per year through at least 2026, off a 2024 base.

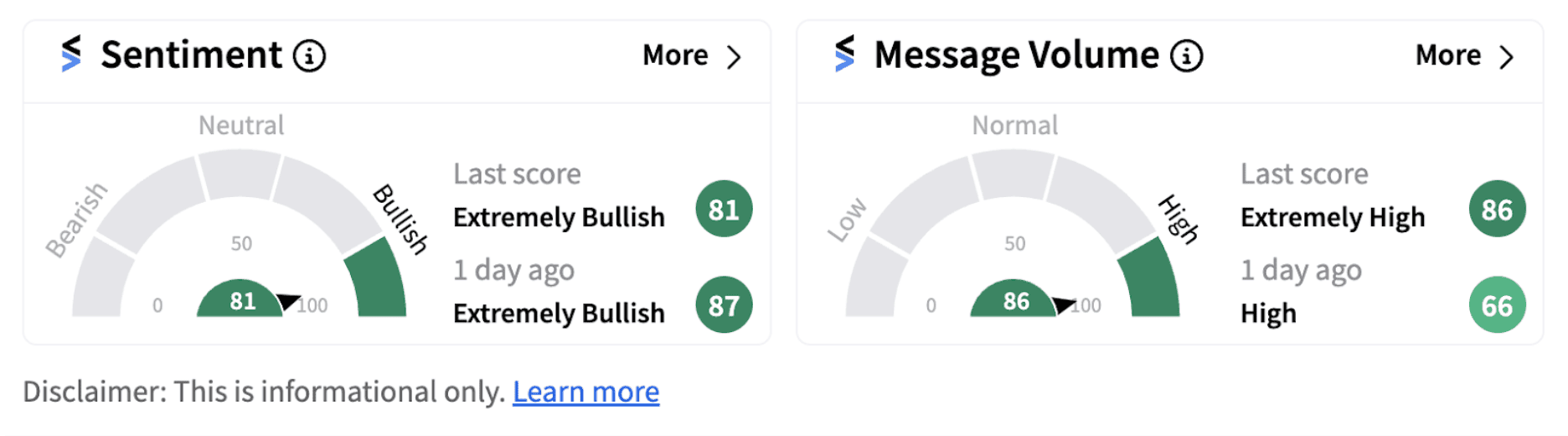

Following the earnings announcement, retail sentiment on Stocktwits continued to trend in the ‘extremely bullish’ territory (81/100), accompanied by ‘extremely high’ message volumes.

On a year-to-date basis, the stock has gained over 39%, significantly outperforming the benchmark U.S. indices.

Also See: General Dynamics Stock Falls Premarket After Earnings Misses Estimates: Retail Sentiment Takes A Hit

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)