Advertisement|Remove ads.

Netflix Stock Jumps After Earnings Beat: Wall Street Applauds, Stocktwits Sentiment Muted

Shares of Netflix, Inc. ($NFLX) rose over 5% pre-market Friday following better-than-expected quarterly earnings, though retail sentiment on Stocktwits remained lukewarm.

The streaming giant reported third-quarter revenue of $9.83 billion, a 15% increase from a year earlier, surpassing Wall Street’s estimate of $9.77 billion.

Net income jumped 41% to $2.36 billion, marking Netflix’s most profitable quarter to date, with adjusted earnings per share coming in at $5.40, beating the consensus of $5.12.

Netflix also added 5.07 million subscribers during the quarter, well above the projected 4.52 million.

However, that represents a significant slowdown compared to the 8.76 million net new subscribers in the same period last year when the company’s password-sharing crackdown first took hold.

Despite speculation, Netflix did not announce a U.S. price hike alongside its Q3 report, a move some analysts had anticipated.

Following the earnings release, at least nine Wall Street analysts raised their price targets on Netflix.

Pivotal Research, already Netflix’s biggest bull, increased its target to $925 from $900, implying a 34% upside from the last close.

However, caution lingered among some analysts. Barclays maintained an ‘Underweight’ rating with a $550 price target, expressing concerns over Netflix’s ability to drive substantial revenue growth without significant price increases or subscriber gains.

Barclays believes Netflix’s current valuation hinges on revenue growth remaining in the mid-teens, but the firm is skeptical this will be achieved without a major boost in subscribers or prices next year. The brokerage also anticipates Netflix’s margin expansion will slow in 2025 and beyond.

Goldman Sachs maintained a ‘Neutral’ rating with a $705 price target, predicting a “muted to positive” market reaction to the Q3 results. While revenue exceeded expectations and operating margins outperformed, net subscriber additions fell short of Goldman’s forecasts.

The brokerage also pointed out that Netflix’s guidance for 2025 includes expectations for solid revenue and profit growth, supported by investments in ads, gaming, and its core content offering.

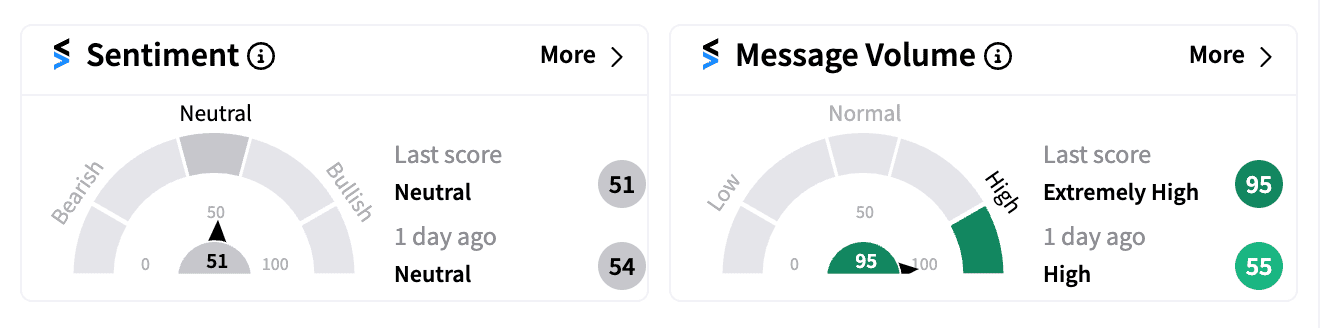

On Stocktwits, the cautious sentiment was echoed among Netflix’s 483,000 followers. Despite the earnings beat, retail sentiment remained ‘neutral’ with message volume at ‘extremely high’ levels.

One bullish user thought the earnings “were great for the long term.”

However, a bearish user believed the stock should trade in the $400-$600 level as the “growth multiple doesn’t match the subscriber growth.”

Netflix shares have gained over 45% this year, significantly outperforming both the S&P 500 and the Nasdaq.

Read next: Sobr Safe Stock Rockets 121% Premarket After Firm Withdraws Contemplated Public Offering

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)