Advertisement|Remove ads.

Indian Markets End Lower For Third Session With Nifty Below 24,600; Fertilizer Stocks Surge, Adani Shares Tumble

Indian equity benchmarks ended sharply lower on Tuesday, as profit booking continued on Dalal Street amid sustained selling by foreign institutional investors and concerns over global trade tariffs.

The Sensex ended 636 points lower to close at 80,737, while the Nifty 50 fell 174 points to finish at 24,542.

After hitting a fresh record high of 56,161 in early trade, the Nifty Bank index reversed gains, ending in the red as investors turned cautious ahead of the Reserve Bank of India’s (RBI) interest rate decision on Friday.

The broader markets too lost some shine, with the Nifty Midcap index losing 0.4% and the Smallcap index ending flat.

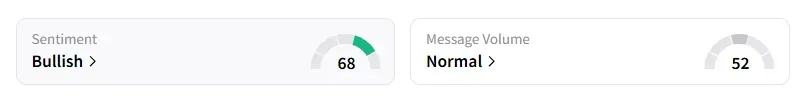

However, retail investor sentiment surrounding the Nifty 50 remained ‘bullish.’

On the sectoral front, real estate stocks rallied on hopes of a rate cut this week, but the rest of the sectors ended in the red.

Fertilizer stocks were on a roll on Tuesday. FACT surged 17% while NFL (+8%), RCF (+7%), and GNFC (+3%) also recorded significant gains. Reports indicated that the Indian government plans to enact stricter legislation to combat the sale of counterfeit fertilizers and other agricultural products.

Ship-building stocks like GRSE and Cochin Shipyard saw gains, ending 6% higher.

Adani Group stocks tumbled on reports of a U.S. probe into Iranian LPG trade via Mundra port. Adani Ports and Adani Enterprises were the top Nifty losers, ending 2% lower.

Vodafone slipped 4% as the debt-laden telco resumes talks with the government seeking relief on its ₹30,000 crore AGR dues.

Yes Bank shares tumbled 10% on reports of a large block deal (3% stake sold). The bank is also considering fundraising at its board meeting on Tuesday.

Ola Electric (-7%) and Aptus Value (-9%) fell sharply amid block deal activity.

Grasim emerged as the top Nifty gainer, rising nearly 2% after board approval to raise ₹1,000 crore via non-convertible debentures (NCDs).

Biocon ended 1% higher on CDSCO nod for diabetes drug

Waaree Renewables rose 1% after securing a Letter of Award (LOA) worth nearly ₹346 crore.

Globally, European markets traded mixed, and Dow Futures indicated a weak opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1463539842_jpg_bcfa58ea0b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_resized_1a6adb0393.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)