Advertisement|Remove ads.

India Market Watch: Nifty Ends Below 25,000 As Tech, Defense Stocks Slide

Indian equity markets ended lower on Monday, amid profit booking in the technology and defense sectors, amid weak global sentiment.

The Nifty50 fell 74 points to close at 24,945, slipping below the key psychological 25,000 mark, while the Sensex ended 271 points lower at 82,059.

Broader markets, however, showed resilience, with the Nifty Smallcap index eking out modest gains.

Sectorally, technology stocks were the biggest losers, followed by media, oil and gas. Conversely, real estate and PSU bank stocks were among the top performers.

Vodafone Idea plunged 8% after the Supreme Court dismissed its plea regarding adjusted gross revenue (AGR) dues.

Bajaj Auto gained 4%, topping the Nifty, after its European subsidiary secured a €566 million unsecured loan for restructuring KTM AG.

HEG (+8%) and Graphite India (+15%) surged after their Japanese rival exited production in China and Malaysia, potentially easing supply pressure.

On the earnings radar, Delhivery rallied 10% after posting its first-ever full-year net profit in FY25, boosting investor sentiment. Divi’s Laboratories gained 5% on strong March quarter earnings.

Protean eGov nosedived 20% after losing a key government tender related to the PAN 2.0 initiative.

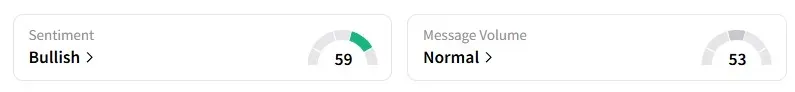

Retail investor sentiment on Stocktwits remains ‘bullish’ on the Nifty 50.

Globally, European markets traded lower, and U.S. futures pointed to a weak open.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)