Advertisement|Remove ads.

Bullish Breakout For Nifty: SEBI RAs See Rally To 26,000 And Beyond

The Nifty 50 delivered a powerful breakout session on June 26, rallying over 300 points to close at 25,549, marking its highest level in nearly 9 months.

SEBI-registered analyst Mayank Singh Chandel noted that this breakout occurred following a clean breach above the falling trendline resistance, further supported by a sustained drop in the India VIX, which hit a three-month low, indicating reduced volatility and improved market confidence, as well as easing global headwinds and geopolitical stability.

On the technical side, the Nifty index formed a strong bullish candle, decisively breaking out of the 25,300–25,350 consolidation zone.

Momentum indicators, such as the Relative Strength Index (RSI) (66+), continue to trend higher without entering overbought territory, which is a healthy sign for further upside. Chandel adds that the trendline breakout suggests a potential trend continuation, backed by volume and broader market participation.

He sees support between 25,300 and 25,350. Adding that any dip here may attract buying interest. Resistance is seen at 25,800–26,000 (likely targets in the short term if momentum sustains)

The weekly expiry derivatives data shows there is heavy put writing at the 25,500 strike, which indicates a strong base formation at this level. And the Put-Call Ratio (PCR) is moving higher, reinforcing a bullish market tone.

Chandel concluded that with a firm close above 25,500, the path toward 25,800–26,000 is likely to open in the near term. However, he advised traders to monitor intraday volatility post-expiry and avoid chasing at higher levels. Buying on dips remains a favorable strategy as long as 25,300 is maintained.

Bharat Sharma of Stockace Financial Services reiterated what he had previously stated in multiple outlooks: once the index breaches its consolidation range, a move toward a new all-time high (ATH) would be underway. He also added that the rally witnessed on expiry day, however, was atypical, appearing suspicious and seemingly influenced by large market participants.

Looking ahead, Sharma sees no significant resistance until the previous peak near 26,300, with 25,800 as a minor resistance level. He believes that the market is headed towards a new ATH.

For intraday trading, he suggested that traders follow the momentum above 25,500. Immediate support is identified at 25,500, with further support levels at 25,400, 25,300, 25,250, and 25,200.

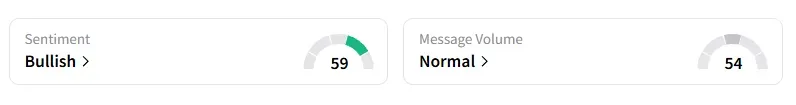

Data on Stocktwits shows that retail sentiment remained ‘bullish’ on the Nifty index.

The Nifty has risen 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)