Advertisement|Remove ads.

Nifty Technicals Signal More Downside: SEBI Analyst Flags ‘Sell On Rise’ Strategy This Week

Indian equity markets saw a sharp correction last week, with the Nifty index tumbling 2.65% and erasing more than 60% of the gains from the prior three weeks. The index shed nearly 700 points in just five sessions, which showed the dominance of bearish sentiment.

The steepest drag came from IT stocks, which declined nearly 8% following the US administration’s decision to levy a $100,000 fee for H-1B visas, creating uncertainty for outsourcing firms. Adding to the pressure, a 100% tariff on pharmaceutical imports dampened sentiment for export-oriented pharma counters, extending weakness across the broader market.

Will the markets see a relief rally this week? SEBI-registered analyst Mayank Singh Chandel shared the trade outlook for the trading week ahead on Stocktwits.

The Week Ahead: Technical Outlook

Chandel noted that on the weekly chart, the index has slipped below the 10- and 20-week Exponential Moving Averages, signalling short-term trend weakness. Meanwhile, on the daily chart, the Nifty closed below key moving averages — the 20-, 50-, and 100-day EMAs, all of which have started turning downward, confirming pressure in the near term.

Momentum indicators have also reinforced fading bullish momentum with the weekly Relative Strength Index (RSI) cooling off to around 50.

Key Levels To Watch

On the downside, crucial support was identified at the 200-day EMA zone of 24,400–24,350 in the coming sessions. He highlighted that a decisive breach below 24,350 could accelerate the slide toward 24,000. On the upside, the immediate resistance is placed around 24,850–24,900, which also aligned with the gap-down created on Friday. Only a sustained close above this zone will hint at stability.

Chandel believes that unless the Nifty index decisively reclaimed the 25,000 mark, rallies are likely to be sold into. He added that the overall structure suggests the index is in a vulnerable zone, with a sell-on-rise strategy remaining the preferred approach until strong evidence of a reversal emerges.

He advised traders to remain cautious, particularly as volatility is expected to remain elevated due to ongoing global policy uncertainties.

What Is The Retail Mood?

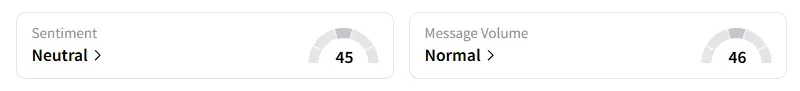

Data on Stocktwits shows that retail sentiment is ‘neutral’ on the Nifty index.

Nifty has gained 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)