Advertisement|Remove ads.

Nifty Reclaims 25,000 As RBI Surprises With Dual Rate Cuts; Realty, Gold Finance Stocks Shine

Indian equity markets witnessed a stellar resurgence on Friday, spurred by the Reserve Bank of India’s (RBI) 50 basis points repo rate and 100 basis points cash reserve ratio (CRR) cut.

The Nifty ended at the psychological 25,000 mark, while the Nifty Bank surged to a fresh record high.

For the week, benchmark indices recorded a gain after two consecutive weeks of declines.

The Sensex ended 746 points higher to close at 82,188, while the Nifty 50 rose 252 points to finish at 25,003.

The broader markets mirrored the optimism, with the Nifty Midcap index gaining 1.2% and the Smallcap index rising 0.8%.

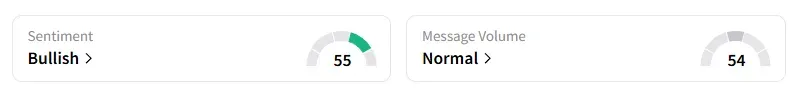

Retail investor sentiment surrounding the Nifty 50 remained ‘bullish.’

Except for the media sector, all sectoral indices ended in the green, led by strong moves in rate-sensitive indices: real estate (+5%), autos (+1.5%), and private banks (+1.7%).

Nifty gainers included Shriram Finance, Bajaj Finance, JSW Steel, Axis Bank, and Maruti.

Only four Nifty stocks ended in the red: HDFC Life, BEL, Bharti Airtel, and Sun Pharma, fell between 0.5% and 1%.

Gold finance companies, such as Manappuram Finance and Muthoot Finance, rallied 6% after the RBI eased the proposed draft norms on gold loans. The central bank has raised the loan-to-value (LTV) ratio from 75% to 85% for loans up to ₹2.5 lakh, including interest.

Defense stocks witnessed some profit booking, dragged by a decline in GRSE, Paras Defence (-4%), Zen Tech (-5%), and Data Patterns (-3%).

Tejas Networks gained 2% after the company won an order worth ₹123 crore under the PLI scheme

European markets traded mixed, and Dow Futures indicated a weak opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)