Advertisement|Remove ads.

India Market Wrap: Nifty Holds 25,000 In Rangebound Session As US-India Trade Talks Drag

Indian equity markets ended a rangebound session on a subdued note on Tuesday, with the Nifty index holding the 25,000 level. Reports suggest that a mini trade deal between India and the US is unlikely before the August 1 deadline, and talks are expected to continue next week.

On Tuesday, the Sensex closed 13 points lower at 82,186, while the Nifty 50 ended 29 points lower at 25,060. Broader markets underperformed, with the Nifty Midcap index falling 0.6% and the Smallcap index ending 0.3% lower.

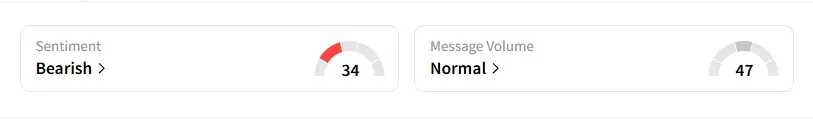

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Sectorally, all indices ended in the red, led by media (-2.2%), PSU banks (-1.5%), pharma, and real estate (-1%).

Eternal surged 10% on stellar June quarter performance and brokerage upgrades. Swiggy (+6%) shares also rose the most in five months. Meanwhile, Info Edge surged 4% (it holds 4% stake in Eternal).

Blue Jet Healthcare shares crashed 10%, Kirloskar Pneumatic fell 11%, and Zee Entertainment declined 6% on disappointing Q1 numbers. On the other hand, SML Isuzu rose 10% post Q1 earnings.

Investors will be watching for Paytm (+3%) as it reports earnings after market close.

And Titan ended 1% higher, driven by its acquisition of Damas, a Dubai-based premier luxury jewellery retailer.

Markets: What Next?

SEBI-registered analyst Ashish Kyal noted that the Nifty needs to close above Monday’s high, which was near 25,111, to shift the daily bias to the upside. If the index moves above 25,130, a retest of the 25,200 levels is expected. But a break below 24,980 would be concerning. The open interest (OI) profile indicates a range-bound movement between 25,200 and 24,980.

Meanwhile, Nikhil Gangil shared July outlook for markets. He noted that the Intrinsic Value Valuation Index is showing markets are again entering the overvalued territory. While the Headwind-Tailwind Indicator gave a tailwind signal around May-June 2025, but was now showing signs of reversal. Gangil advised traders to avoid momentum-based picks and instead focus on value investing and discipline allocation.

Globally, European markets traded mixed, while US stock futures indicate a cautious start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Palo_Alto_logo_1200pi_resized_jpg_eee56769fa.webp)