Advertisement|Remove ads.

Nifty Reclaims 25,200, Led By Financials, Auto; Infosys Lifts Lower End Of FY26 Guidance

Indian equity markets ended higher, tracking positive global sentiment after the US signed a trade deal with Japan. The Nifty index reclaimed the 25,200 level, led by buying in financials, auto and healthcare stocks.

Infosys earnings came in post-market hours. Q1 revenue rose 8% to ₹42,279 crore, while profits stood at ₹6,921 crore. The IT major has raised its lower band of the revenue growth guidance to 1% to 3% from 0% to 3%, while margin guidance is maintained at 20-22%.

On Wednesday, the Sensex closed 539 points higher at 82,726, while the Nifty 50 ended 159 points higher at 25,219. Broader markets outperformed, with the Nifty Midcap index rising 0.3% and the Smallcap index ended flat.

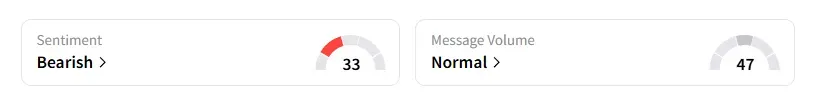

However, the retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Sectorally, barring real estate (-2.7%), media (-1%) and FMCG (-0.6%), all other sub-indices ended in the green.

Paytm shares recouped opening losses to end nearly 2% higher after it reported its first-ever profit for June quarter, amid improvement in operational performance.

Colgate (-4%) hit a new 52-week low after its Q1 earnings missed street estimates. Citi maintained a ‘Sell’ rating and revised its target price lower to ₹2,175 from ₹2,300

The other earnings movers include Dixon Technologies (+3%), IRFC (+3%), CreditAccess (+5%), Dalmia Bharat (-2%) as investors parsed their quarterly performance.

Focus shifts to Dr Reddy’s and Tata Consumer that are set to report Q1 earnings after market close.

Tata Motors was the top Nifty gainer (+2.6%) ahead of the India-UK free trade agreement deal that will be signed tomorrow. Also, sentiment boost coming in from the US-Japan trade deal, which reduced tariffs on Japanese vehicles entering the US market.

Ola Electric surged 7%, while Lodha (-7%) and Oberoi Realty (-3%) shares fell on the back of large block deals.

Globally, European markets traded higher, while US stock futures indicate a positive start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)