Advertisement|Remove ads.

Weekly Gains: Nifty Ends Near 24,900, Sensex Reclaims 81,000

Indian equity markets saw a strong recovery in the last hour of trade, with the Nifty index ending over 24,800 and the Sensex reclaiming 81,000. For the week, the benchmark indices have risen 0.5%.

On Friday, the Sensex closed 223 points higher at 81,207, while the Nifty 50 ended up 57 points at 24,894. Broader markets outperformed, with the Nifty Midcap and Smallcap indices gaining 0.7%.

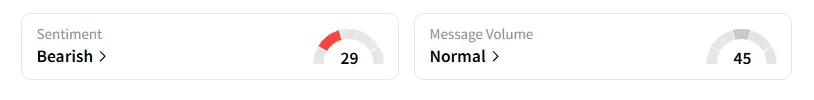

However, the retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Stock Moves

Sectorally, barring healthcare and select auto, media, and real estate, the rest of the indices ended in the green. Metals, PSU banks, and consumer durables saw strong buying.

V-Mart Retail ended 17% higher following robust Q2 operational update of 22% year-on-year growth in revenue from operations.

Atlantaa shares were locked on 20% upper circuit for second session after winning a mega order from IRCON earlier this week.

L&T shares closed 2% higher after its vertical bagged order worth ₹5,000-₹10,000 cr.

Defense stocks gained ground. Paras Defence rose 5% on an order win. While Data Patterns, Azad Engineering and Astra Micro rallied between 7% and 11% on the back of a bullish brokerage note from Goldman Sachs.

Tata Investment fell 5% ahead of Tata Capital’s IPO that opens next week. For the week, however, it has surged 20%,.

Waaree Energies ended over 3% higher after the board approved capex of ₹8,175 cr to increase capacity across segments. And PTC Industries rallied 6% on an order win and a bullish call from Goldman Sachs.

And Sammaan Capital fell 3% after a major stake sale to IHC.

Stock Calls

Ashok Kumar Aggarwal of Equity Charcha is bullish on Shriram Transport Finance. Its technical indicators are showing strength and positive momentum. He recommended a short-term buy between ₹640 and ₹644, with a stop loss of ₹620 and a target price at ₹685.

Krishna Pathak shared a trading call on KRN Heat Exchanger. He identified a support zone at ₹720-₹700 with a strong demand area. On the upside, resistance is seen at ₹850, near its 9-day EMA. Pathak recommended an add-on opportunity at ₹780–₹800 zone, where past buying interest was visible, with targets set at ₹930, ₹980, and ₹1,030.

He noted that KRN stock was still holding its ascending trendline from May, and as long as it sustains above ₹740–750, the structure stays positive. In the short-term, Pathak is bullish above ₹850; but cautious if price slips below ₹720. A breakout above ₹850 with strong volumes may trigger upside momentum. A breakdown below ₹720 can pull it down to ₹700.

Markets: What Next?

Analyst Ashish Kyal said that the Nifty index is forming a small pennant pattern. A break above 24,860 is expected to resume the positive trend toward 24,970 and beyond. The Gann support at 24,728 has been protected with the low hitting 24,747 before prices reversed upward. The AK indicator shows that when all lines touch and move upward, it will serve as a classic confirmation to buy.

Globally, European markets traded higher, while US stock futures indicate a positive start on Wall Street as the US government shutdown enters the third day.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)