Advertisement|Remove ads.

Indian Markets At Close: Nifty Ends Above 25,100, Posts Biggest Weekly Gain In 3 Months

Indian equity markets ended higher for the second week in a row, posting their biggest weekly gain in nearly three months. The Nifty index reclaimed the 25,100 mark, led by buying in defence, metals, and IT this week.

On Friday, the Sensex closed 355 points higher at 81,904, while the Nifty 50 ended up 108 points at 25,114. Broader markets mirrored the optimism, with the Nifty Midcap index rising 0.3% and the Smallcap index gaining 0.6%.

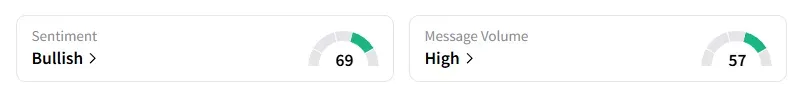

The retail investor sentiment surrounding the Nifty 50 was ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, barring FMCG, the rest of the indices ended in the green, led by metals, pharma, and select financials.

Infosys ended 1% higher following its biggest-ever buyback offer worth ₹18,000 crore,

Defense stocks rallied on Friday, with the Nifty India Defence Index surging 4%. Garden Reach Shipbuilders & Engineers and MTAR Technologies rallied 10%, followed by BEML, Astra Micro, and Cochin Shipyard, gaining 7%.

Metals were the other gainers in trade. Hindustan Copper ended 12% higher, driven by an ambitious capital expenditure (capex) plan of ₹2,000 crore over the next five to six years, aiming to boost its mining operations and expand capacity.

JBM Auto ended 13% higher after its subsidiary received a $100 million investment from the International Finance Corporation (IFC) to deploy electric buses in Maharashtra, Assam, and Gujarat.

Stock Calls

On Infosys, analyst Kush Ghodasara noted that according to Elliott wave theory, some consolidation is likely, if not a crackdown. He advised traders to go long above ₹1,545 and short below ₹1,435.

Sumesh Guleria flagged that Apollo Micro shares have delivered over 150% return in the last 6 months. But, it is facing a strong resistance at ₹340-₹350, and he expects a high chance of profit booking at these levels.

Vinay Taparia highlighted a breakout in Shriram Properties with good volumes. The stock can move to ₹110 in the short term, but a close below ₹88 negates this view.

Markets: What Next?

Globally, European markets traded mixed, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)