Advertisement|Remove ads.

Nifty Ends Above 25,300 Ahead Of US Fed Decision; PSU Banks Lead The Gains

Indian equity markets gained ground on optimism around a US-India trade deal and ahead of a crucial US Federal Reserve rate decision, which is due tonight. The Nifty ended above the 25,300 mark.

On Wednesday, the Sensex closed 313 points higher at 82,693, while the Nifty 50 ended up 91 points at 25,330. Broader markets underperformed, with the Nifty Midcap index ending flat and the Smallcap index gaining 0.6%.

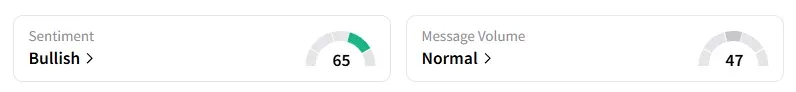

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

Sectorally, financials, especially PSU banks, led by SBI and PNB, led the gains. The defense and textile stocks gained ground for the third session this week. On the flip side, pharmaceuticals, metals, FMCG, and consumer durables saw some selling pressure.

Vedanta closed 1% lower after the government raised four key concerns over the demerger proposal in the NCLT hearing today.

Jindal Steel ended 2% lower after it submitted a bid for Thyssenkrupp’s steel division. On its technical front, SEBI analyst Prabhat Mittal noted an ascending triangle pattern on its charts above ₹1,010, paving the way to ₹1,300. The stock was trading above all key averages, along with other technical indicators flashing a bullish signal. He recommended buying at ₹1,043 with a strict stop loss below ₹939 for a target price of ₹1,300.

Dreamfolks was locked in a 5% lower circuit after it exited the domestic lounge services business. On the other hand, AB Fashion and Retail shares ended 4% higher following the launch of a new brand.

MCX ended over 3% higher on reports that the market regulator was considering opening up participation in the commodity derivatives market.

New Debuts: Urban Company listed with a premium of 60%, while Shringar House of Mangalsutra listed at a 14% premium over its IPO price of ₹165.

Stock Calls

Ashok Kumar Aggarwal of Equity Charcha recommended buying Agarwal Industrial following a tender win from Indian Oil Corporation (IOC). Technical charts show strength in the stock. For the short term, he shared a buy call between ₹928-₹935, with a stop loss at ₹900 for a target price of ₹1,015.

Vinay Taparia is bullish on Sansera Engineering following a good breakout with volumes. He believes that the stock could move to ₹1,700 in the short term, with support at ₹1,450. But a close below ₹1,394 negates this view.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a cautious start on Wall Street as investors await the US Federal Reserve’s rate decision.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)