Advertisement|Remove ads.

TCS Miss, Trump Tariffs Drag India Markets Lower; Nifty Ends Second Week In The Red

Indian equity markets ended sharply lower, with the Nifty index breaking below the crucial support level of 25,200. Investor sentiment was weak after Tata Consultancy Services (TCS) kick-started the Q1 earnings season with a weak show, and global trade tensions escalated with US President Donald Trump imposing fresh tariffs on Canada.

For the week, the benchmark indices clocked in their second consecutive week of losses, ending down over 1%.

On Friday, the Sensex closed 737 points lower at 82,452, while the Nifty 50 ended 214 points lower at 25,140. Broader markets mirrored the weakness, with the Midcap index and the Smallcap indices falling over 1%.

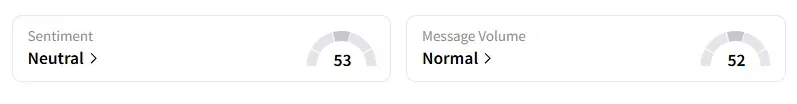

The retail investor sentiment surrounding the Nifty 50 has moved from ‘bullish’ to ‘neutral’ on Stocktwits.

Sectorally, except pharma and FMCG, the rest of the indices ended in the red, led by IT, auto, media, real estate, oil and gas.

Hindustan Unilever was the top Nifty gainer, closing 5% higher as the street cheered its leadership change at the helm. On the other hand, TCS was the top Nifty loser, ending 4% lower and dragging the rest of the IT sector as well: Infosys, HCL Tech, and Wipro ended 1% to 3% lower.

Glenmark Pharma surged 15% on inking a licensing deal with AbbVie for a cancer treatment drug.

Elecon Engineering, IREDA, and Tata Elxsi were the other laggards, on the back of disappointing Q1 earnings.

Zee Entertainment ended down 4% after its shareholders rejected the proposal to raise ₹2,237.44 crore from promoter entities.

M&M and Tata Motors ended over 2% lower after Tesla announced its first store launch in Mumbai on July 15.

Globally, European markets traded lower, while US stock futures indicate a positive start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)