Advertisement|Remove ads.

Late Sell-Off Drags Nifty Below 25,500 In Choppy Expiry; Pharma, Auto Stocks Buck The Trend

A late sell-off on Dalal Street dragged the Indian equity markets to end lower in a choppy weekly options expiry session on Thursday, with the Nifty closing around the 25,400 mark. Reports suggest that India and the United States are close to finalizing a mini-trade deal, with an announcement likely this weekend.

The Sensex closed 170 points lower at 83,239, while the Nifty 50 closed 48 points lower at 25,405.

Broader markets outperformed with the Nifty Smallcap index gaining 0.3%, while the Midcap index ended flat.

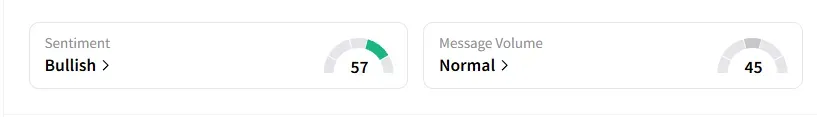

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, metals, banks and real estate witnessed selling pressure, while pharmaceuticals, consumer durables and auto stocks gained on Thursday.

Nykaa (FSN E-Commerce Ventures) shares fell 4% following a large block deal that saw nearly six crore shares (2.3% equity) worth ₹1,210 crore.

Shares of Punjab National Bank fell 3% after the lender reported its business update for the first quarter of the current financial year, which failed to impress the street.

Avenue Supermarts shares fell over 1% following their first quarter (Q1FY26) business update. Goldman Sachs has a ‘Sell’ rating, with a target price of ₹3,400, indicating 21% downside.

HDB Financial Services extended its gains, a day after listing, closing 4% higher.

Motilal Oswal Finance shares surged 7%, hitting a 5-month high, after its asset management arm, Motilal Oswal AMC surpassed ₹1.5 lakh crore in assets under management (AUM).

And Bajel Projects rallied 5% after receiving an order worth ₹300-₹400 crore from Power Grid for a 400kV transmission line.

On the technical front, SEBI-registered analyst Kush Ghodasara shared a Sell Today, Buy Tomorrow (STBT) strategy on ICICI Bank. The stock appeared to have hit a resistance at ₹1,470, which marked its previous high, forming a double top pattern.

Although confirmation would occur at ₹1,405, Ghodasara suggests taking an early short position, as the stock closed below its short-term average of ₹1,440, and technical indicators have turned negative. The recommended trade setup involves shorting at the current market price, with targets set at ₹1,418 and ₹1,378. A stop loss is advised at ₹1,457.

Globally, European markets traded mixed, and Dow Futures indicated a subdued opening for Wall Street. Thursday’s session will be shortened due to the Independence Day holiday observed on Friday for the US markets.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)