Advertisement|Remove ads.

Nifty Ends Below 25,000 As Geopolitical Tensions Mount; Mid, Smallcaps Buck The Trend

Indian equity markets failed to hold on to their intraday recovery, with the Nifty ending below the 25,000 mark. Investors remain cautious as they await Tehran’s reaction to the U.S. attacking three Iranian nuclear facilities over the weekend.

The Sensex ended 511 points lower to close at 81,896, while the Nifty 50 fell 140 points to finish at 24,971.

Broader markets staged a strong recovery, with the Nifty Midcap index rising 0.3% and the Nifty Smallcap index closing 0.7% higher.

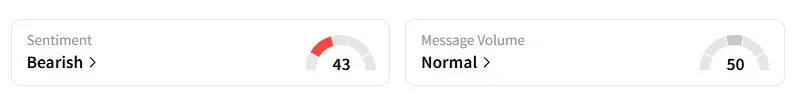

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ on Stocktwits.

Sectorally, the Nifty IT ended 1.5% lower, while media, metals, pharma, and consumer durables held on to gains.

Technology stocks witnessed selling pressure, led by Infosys and HCL Technologies, which ended over 2% lower on Accenture’s subdued guidance and drop in deal bookings in the third quarter.

Defense stocks saw strong buying interest, led by GRSE (+6%), Paras Defence, and Zen Technologies (+5%). BEL shares hit a fresh 52-week high, ending 3% higher, and Ideaforge rallied 10%, hitting an upper circuit after the defense company bagged a ₹137 crore order to supply Mini Unmanned Aerial Vehicles (UAVs) to the Ministry of Defence (MoD).

SEBI-registered analyst Lalit Mundhra flagged a breakout alert in Bharat Forge. The stock has seen a classic retest of its previous support with strong volume, and its technical charts suggest a bullish reversal after accumulation. He suggests watching ₹1,305 and above for further upside.

Zee Entertainment shares surged 12% after the company shared optimistic growth plans in an investor presentation. It aims to break even in its digital business (Zee 5) in this financial year, compared to an Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) loss of ₹548 crore in FY25.

BSE shares rose over 3% and Interglobe Aviation (Indigo) shares ended over 1% higher after news reports indicated that they were likely to be included in the Nifty index in the August review, replacing IndusInd Bank and Hero Motocorp (-2%).

KFin Technologies gained nearly 3%, and Polycab rose 5%, driven by brokerage upgrades.

Ola Electric shares slipped 6% to a record low after a large block deal.

LT Foods ended 6% lower after it disclosed that the US authorities imposed a 340% countervailing duty (CVD) on its subsidiary Ecopure Specialities' exports of organic soybean meals.

Globally, European markets traded broadly lower, and Dow Futures indicated a cautious opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)