Advertisement|Remove ads.

Sell-Off Grips Dalal Street: Nifty Ends Below 24,700; Metals Shine On China Rate Cut

Indian equity markets ended sharply lower on Tuesday, with both benchmark indices shedding 1% in a choppy session.

The Nifty 50 closed 259 points lower at 24,698, slipping below the crucial 24,700 mark, while the Sensex dropped 847 points to end at 81,211.

The selling was triggered by broad-based profit booking, renewed concerns over foreign portfolio investor (FPI) outflows, and waning hopes around a U.S.-India trade breakthrough.

While some Asian markets gained on China’s unexpected decision to cut key lending rates to support its economy, Indian equities failed to hold on to early gains.

Broader markets, which had outperformed for six consecutive sessions, also came under pressure. The midcap and smallcap indices fell over 1.5%, reflecting the intensity of the sell-off across the board.

All sectoral indices ended in the red, with banks, pharma, and FMCG stocks leading the decline.

Defensive stocks also witnessed profit booking, while rail and defense stocks faced selling pressure.

The worst-hit among Nifty stocks was Eternal, which plunged over 4% amid fears of an MSCI index exclusion. The decline came after the company’s move to become an Indian Owned and Controlled Company (IOCC). Eternal’s shareholders have approved a 49.5% foreign ownership cap.

The metals sector bucked the trend, rising on the back of China’s rate cut and improving global sentiment. Coal India, Tata Steel, and Hindalco gained between 1% to 2%, with Hindalco receiving a boost from strong operational fourth-quarter (Q4) performance.

On the earnings front, DLF rose 3% after posting robust Q4 numbers and record property sales. Restaurant Brands Asia jumped 5% on upbeat quarterly results.

Pfizer India rallied 9%, driven by healthy margins and a strong operational quarter.

Newgen Software emerged as the top gainer on the NSE 500 index, soaring 19% after it reported strong Q4 revenue growth, margin expansion, and upbeat guidance.

Nazara Tech climbed over 2% after its board approved an in-principle nod for its U.K. arm to acquire Curve Digital for ₹247 crore.

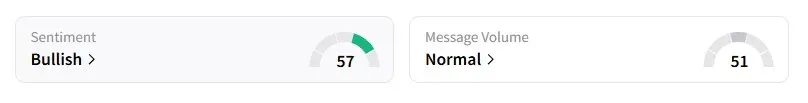

Despite the day's fall, retail investor sentiment on Stocktwits remained ‘bullish’ on the Nifty 50, indicating underlying optimism.

Globally, European markets traded higher, and U.S. futures pointed to a subdued open ahead of key Fed commentary.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)