Advertisement|Remove ads.

Bulls Take A Breather, Nifty Holds 25,000; TCS Shines Ahead Of Q2 Earnings

Indian equity markets snapped a four-day winning streak due to profit booking, but the Nifty managed to hold the crucial 25,000 mark. Barring IT and consumer durables, all the indices ended in the red, led by selling in autos, media, real estate, and energy.

On Wednesday, the Sensex closed 153 points lower at 81,773, while the Nifty 50 ended down 62 points at 25,046. Broader markets underperformed, with the Nifty Midcap index falling 0.7% and the Smallcap index declining 0.5%.

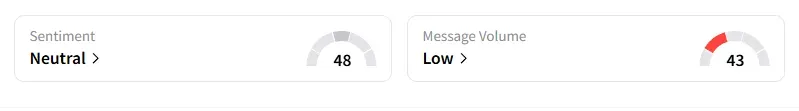

However, the retail investor sentiment surrounding the Nifty 50 moved from ‘bearish’ to ‘neutral’ by market close on Stocktwits.

Stock Moves

TCS ended 2% higher ahead of its September quarter (Q2 FY26) earnings report tomorrow.

Titan was the top Nifty gainer, ending over 4% higher on the back of robust business updates for Q2. Meanwhile, Tata Motors was the top Nifty loser, sliding 2%.

Samvardhana Motherson ended 2% lower after its client, BMW, issued a profit warning due to pressure in China.

And Salzer Electronics surged 20% after it was granted a patent for a compact high-voltage safety device.

Stock Calls

Mayank Singh Chandel flagged a reversal play in Salzer Electronics. The stock has bounced sharply from a strong support level, with huge volumes. And its Relative Strength Index (RSI) divergence hints at an early sign of trend reversal. Chandel recommended entry at the current market price with a stop loss below ₹740. He identified a short-term target of ₹1,000 and a long-term target of around ₹1,500.

Palak Jain is bullish on NALCO. It has formed a rounding bottom breakout above resistance on a volume spike. Additionally, the RSI and DMI confirm a bullish setup, indicating further upside potential. She added that the volume breakout after a year-long consolidation signals a high probability for a sustained rally.

Jain recommended buying above ₹226, with a stop-loss at ₹211, for target prices of ₹233, ₹240, and ₹253.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a subdued start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)