Advertisement|Remove ads.

Indian Markets Extend Losses For Seventh Session; Wockhardt, Vascon, Hindustan Zinc Shine Amid Weak Close

Indian equity markets saw a volatile session, with the Nifty index ending below 24,700 ahead of the weekly expiry session tomorrow and the Reserve Bank of India’s rate decision on October 1. Benchmark indices ended lower for the seventh consecutive session.

On Monday, the Sensex closed 61 points lower at 80,364, while the Nifty 50 ended down 19 points at 24,634. Broader markets were mixed, with the Nifty Midcap rising 0.2% while the Smallcap index ended flat.

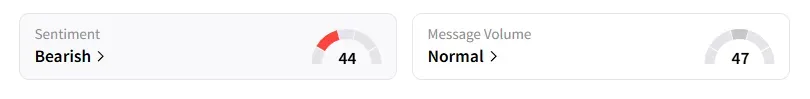

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Analysts warn that unless Nifty reclaims 24,800, the bearish tone will persist, with risks of a slide toward 24,300.

Stock Moves

Sectorally, it was a mixed bag with media, consumer durables and pharmaceuticals saw some selling pressure. On the other hand, PSU banks, real estate and energy ended higher.

Wockhardt saw a 15% relief rally following clarification from the US that its proposed pharmaceutical tariffs would only target branded and patented drugs. This is significant as generic medicines constitute the majority of India's pharmaceutical exports to the US, and these will not be affected.

Hindustan Zinc ended nearly 4% higher, driven by record rally in silver prices.

Vascon Engineers ended 20% higher after the company inked a pact with Adani Infrastructure.

Shares of Bharat Electronics (BEL) closed 1% higher after the Indian Army issued a tender worth nearly ₹30,000 crore for the QRSAM (Quick Reaction Surface-to-Air Missile) project.

And Azad Engineering ended 2% higher on securing a ₹651 crore contract with a Japanese company. SEBI-registered analyst Ashok Kumar Aggarwal of Equity Charcha noted that the stock had been in a consolidation phase, trading between ₹1,529 and ₹1,664 over the last six weeks. He recommended a short-term buy between ₹1,560 and ₹1,575, with a stop-loss at ₹1,528 on a closing basis, and a target price of ₹1,662.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a strong start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)