Advertisement|Remove ads.

Indian Markets Remain Subdued; SEBI RA Eyes 25,800 On Nifty If Support Holds

Indian equity markets remained rangebound in listless trade on Tuesday, as investors monitored the ongoing global trade talks with the U.S. ahead of the July 9 tariff deadline.

The Sensex closed 90 points higher at 83,697, while the Nifty 50 rose 24 points to finish at 25,541.

Broader markets snapped a seven-day gaining streak, with the Nifty Midcap index ending flat, and the Smallcap index falling 0.10%.

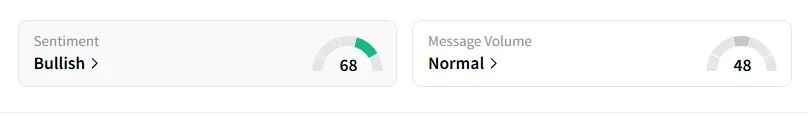

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, media and FMCG were the biggest laggards, followed by IT and auto stocks. PSU banks, metals, and oil & gas gained in trade.

Apollo Hospitals was the top Nifty gainer, ending 4% higher after its board approved a separate listing of its pharmacy and digital health businesses within 18-21 months, as part of a restructuring exercise.

BEL shares hit a record high, ending 3% higher after the defence company won fresh orders worth more than ₹500 crore.

Nuvama, a brokerage firm, has set the highest target price for Reliance shares on the street, raising it to ₹1,801. This news led to a 2% surge in Reliance shares. Nuvama believes the New Energy business will be a game-changer for Reliance.

Gabriel India's shares soared 20%, following the announcement of a business restructuring – it plans to merge Anand Group's auto & related business with itself via a share swap.

Paras Defence surged 2% as the company bagged a letter of intent for an order worth ₹22 crore.

Dixon Technologies ended 2% lower as Morgan Stanley downgraded it to ‘Underweight’ with a target price of ₹11,563, indicating 21% downside, citing execution challenges. NMDC fell 3% after announcing a price cut for lump ores.

And in new listings, Ellenbarrie shares surged on a strong market debut, while Raymond Realty fell after a tepid listing.

SEBI-registered analyst Ashish Kyal highlighted that the Nifty is forming a base again to resume the upmove to 25,800, provided the index does not register a hourly close below 25,460 levels.

A bearish engulfing pattern is not as a reversal unless it is accompanied with a high that is lower than a previous high, and a close below its prior low. Until such a pattern emerges, Kyal advised a ‘buy on dips’ strategy.

Analyst Rajneesh Sharma noted that we are approaching a critical point on Nifty: the price action is making higher highs, but the Chaikin Money Flow (CMF) is diverging negatively, which usually signals exhaustion in buying strength.

For the week, support is strong around 25,050 levels, while the upper trendline is capping the move near 25,660–25,700. Unless we see fresh buying with volume, the index may pause or retrace mildly from here, he said.

Sharma remains neutral on the markets in the medium term, adding that a sustainable move above 25,700 will be crucial for continued momentum.

Globally, European markets traded lower, and Dow Futures indicated a positive opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)