Advertisement|Remove ads.

Tech Stocks Lift Markets, But Nifty Ends Below 26,000 Amid Late Selloff

- Optimism over a possible US-India trade deal lifted sentiment early in the day

- Weak energy and auto stocks pulled indices off highs in the last hour of trade.

- Technology was the top sectoral gainer, while oil and auto counters dragged.

Indian equity markets gave up gains in the last hour of trade, with the Nifty index closing below 24,600. Optimism over a trade deal being finalized between the US and India sparked the momentum. Barring autos, energy, and select healthcare, the rest of the indices ended in the green, with heavy buying in technology stocks.

On Thursday, the Sensex closed 57 points higher at 84,484, while the Nifty 50 ended up 20 points at 25,888. Broader markets underperformed, with the Nifty Midcap and Smallcap indices ending flat.

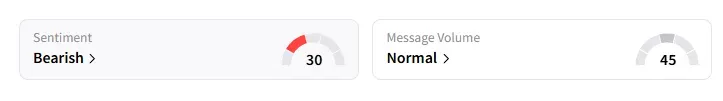

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Stock Moves

Infosys was the top Nifty gainer, ending over 3% higher after its promoters opted out of the buyback plan. Clarifications on the H1-B visa and renewed trade deal optimism sparked a rally across other IT counters such as HCL Technologies and TCS (+2%).

Textiles, seafood exporters shares also saw stellar gains on Thursday: Kitex (+14%), Pearl Global (+6%), Vardhman Textiles (+5%), KPR Mills, Welspun Living (+4%) and Apex Frozen (+6%).

Reliance shares ended 1% lower after reports suggested that they have reportedly halted oil imports under the Rosneft deal. This comes after US President Donald Trump imposed fresh sanctions on Russian oil producers. Indian oil marketing companies such as IOC, HPCL and BPCL fell between 2% and 4%.

In earnings movers, EPack Prefab surged 14% after its Q2 profit doubled.

Stock Calls

Mayank Singh Chandel noted that after an uptrend, IFB Industries’ stock was forming a rounding bottom pattern, which often signals a fresh upward move. A close above ₹1,906 could start a new uptrend. He recommended entering at this level, with a stop loss below ₹1,660, for a target price of ₹2,300.

Priyank Sharma is bullish on TCS. He noted that the stock has been in a downtrend since last year, when it broke the swing low on the weekly chart, marking a 37.5% correction from the highs. Sharma added that this marked a bottom in making for TCS for a long time and reversal here may take the stock to retest the mid-range of last year's correction or a higher level for price discovery, but cautions that this set-up is valid as long as the recent low holds on a weekly closing basis (WCB). He recommended buying at ₹3,090-₹2,950, with a stop loss at ₹2,850 (WCB) for target prices of ₹3,550, ₹4,100, and ₹4,600.

Vinay Taparia sees upside potential in Bank of India till ₹160, but a close below ₹126 negates this view.

Markets: What Next?

Globally, European markets traded mixed, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)