Advertisement|Remove ads.

Benchmark Sees Government Quantum Investments As Strategic Shift In Policy: QBTS, IONQ, QUBT, RGTI Stocks In Focus

- Benchmark analyst David Williams said that the U.S. government’s potential plan to take equity stakes in quantum-computing firms signals a major policy shift.

- The talks reportedly involve D-Wave Quantum, Rigetti Computing, IonQ, and Quantum Computing, with funding tied to ownership stakes.

- David Williams reaffirmed Benchmark’s ‘Buy’ ratings on IonQ, Rigetti, and D-Wave.

Benchmark analyst David Williams said on Thursday that the recent reports of potential federal equity stakes in U.S. quantum-computing firms mark a significant policy shift toward deeper government involvement in critical technology industries.

The analysts’ remarks follow reports citing that publicly traded quantum computing firms, including D-Wave Quantum (QBTS), Rigetti Computing (RGTI), IonQ (IONQ), and Quantum Computing Inc. (QUBT), have been in talks with the U.S. Commerce Department about providing the government with ownership stakes in exchange for federal funding.

Quantum Sector As A Strategic Asset

Williams described the move as “a further shift toward direct government ownership in critical technology sectors,” noting that quantum computing now ranks alongside artificial intelligence, nuclear technology, and space exploration in the federal strategic agenda, according to TheFly.

He said the initiative represents “just one of several potential funding mechanisms” that could emerge as Washington steps up efforts to secure a lead role in next-generation computing.

Benchmark currently holds ‘Buy’ ratings on IonQ, Rigetti, and D-Wave.

How Did The Stock React?

Quantum computing stocks were among the top-trending equity tickers on Stocktwits on Thursday morning. Given below are the latest movements of the quantum stocks.

D-Wave, Quantum Computing, Rigetti, and IonQ stocks traded over 19%, 10%, 12% and 10% higher, respectively, on Thursday morning.

On Stocktwits, retail sentiment towards D-Wave, Quantum Computing, and IonQ turned bullish, whereas sentiment towards Rigetti remained bearish.

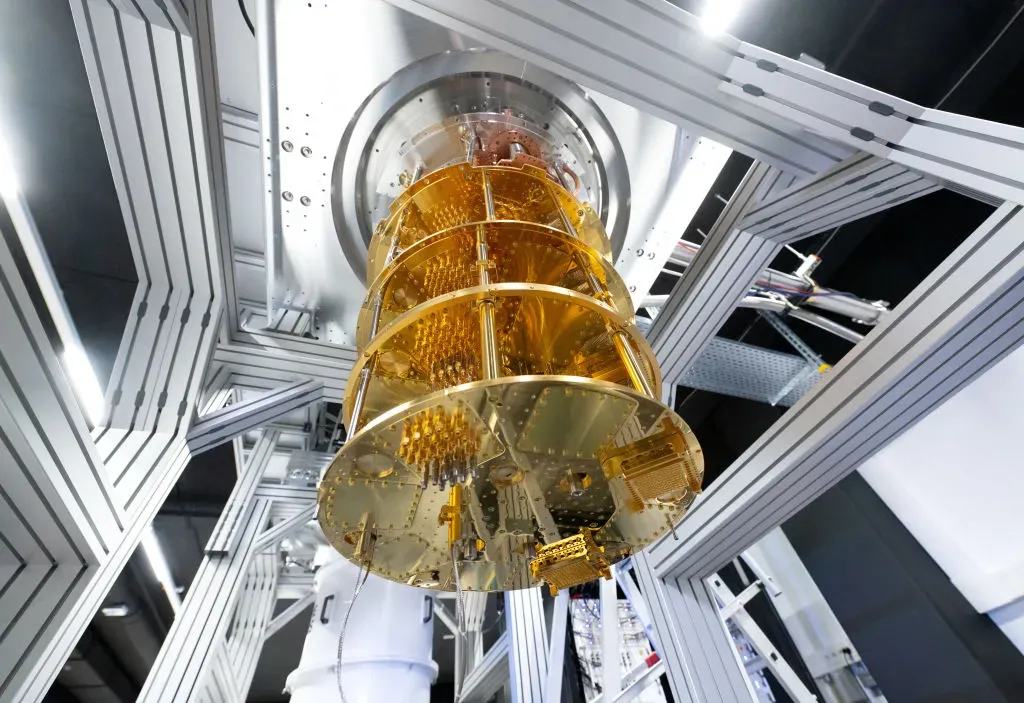

Quantum computing is viewed as a foundational technology for solving complex problems beyond the reach of conventional systems. Its potential applications include advanced cryptography, climate modeling, and materials science.

Advancements in both quantum hardware and software, along with efforts to build more powerful quantum machines, are drawing increased investment into the sector.

Also See: Super Micro Stock Tumbles After Company Slashes Q1 Revenue Outlook

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)