Advertisement|Remove ads.

India Market Wrap: Nifty, Sensex End With Modest Gains Amid Border Tensions; Tata Motors, Paytm, MRF Power Ahead

Indian equity benchmarks ended a volatile Wednesday session with modest gains, as markets reacted to escalating India-Pakistan border tensions.

The volatility followed India’s precision military operation—‘Operation Sindoor’—launched in retaliation for the Pahalgam terror attack.

The Indian Armed Forces conducted missile strikes on nine terror-linked targets across Pakistan and Pakistan-occupied Kashmir (PoK).

The Nifty 50 closed 0.3% higher at 24,414, while the Sensex ended the day up 0.4% at 80,746. The Nifty Midcap index outperformed, gaining 2%, reflecting strong investor interest in broader markets.

Sectorally, all indices except FMCG and pharma ended in the green.

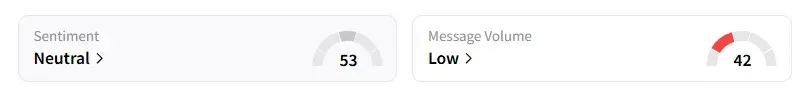

On Stocktwits, retail sentiment surrounding the Nifty 50 remained ‘neutral.’

Paytm shares surged 7% after management guided toward achieving profit after tax (PAT) positivity in the upcoming quarter, a potential turning point for the fintech player.

MRF rallied 4% following a 31% jump in quarterly profits, margin expansion, and the announcement of its biggest-ever dividend payout, signaling robust demand and operational strength.

Tata Motors gained 5%, emerging as the top Nifty performer after shareholders approved its demerger plan, a move analysts say could unlock value. The stock also gained from optimism around the India-U.K. Free Trade Agreement, which is expected to benefit auto exports.

Textile stocks soared, following the finalisation of the India-U.K. Free Trade Agreement (FTA), which removes import duties on garments and fabrics. Gokaldas Exports (+12%), KPR Mills (+9%), and Arvind (+3%) shares were among the major gainers.

In other notable movers, KEI Industries (+4%) and BSE (+7%) surged on strong March quarter earnings.

Despite ongoing geopolitical tensions, select defense stocks experienced profit booking, with Mazagon Dock declining by 6% and Bharat Dynamics by 5%. This follows a recent rally in the defense sector.

Global investors remained cautious ahead of a crucial U.S. Federal Reserve interest rate decision expected on Wednesday. European markets traded lower, while U.S. futures indicated a muted Wall Street open.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)