Advertisement|Remove ads.

Nifty Hovers Below 25,500, Textile Stocks Rally; SEBI RAs See Limited Upside Until Trade Clarity Emerges

Caution prevailed on Dalal Street, with the benchmark indices seeing a subdued start on Tuesday amid fresh global trade jitters. The US President Donald Trump sent tariff letters with steep duties to over a dozen countries, including South Korea and Japan. He has also pushed back the tariff deadline to August 1. Trump indicated that a deal between the US and India is likely to be reached soon.

At 09:40 a.m. IST, the Nifty 50 traded 16 points higher at 25,477, while the Sensex was flat at 83,513. Broader markets underperformed, with the Nifty Midcap falling 0.3% and Smallcap indices down 0.1%.

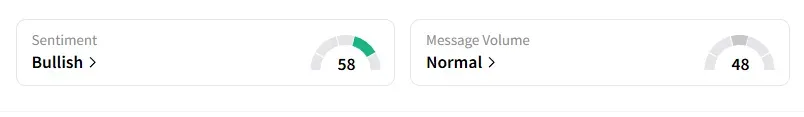

The retail sentiment on Stocktwits for Nifty has remained ‘bullish’.

Sectorally, most indices traded in the red, with consumer durables seeing the most selling (-2%), followed by pharma and real estate (-0.7%). Metals, oil & gas and private banks witnessed minor gains.

The sector in the spotlight today is textiles, with a broad-based rally across stocks following the US's imposition of 35% tariffs on Bangladesh overnight. Vardhman Textiles and Gokladas Exports rose over 5%, while Weslpun and Arvind gained 2%.

Kotak Mahindra Bank shares rose 4%, driven by a strong first quarter (Q1) operational update. The bank reported a 14% rise in first-quarter net advances to ₹4.45 lakh crore, while deposits climbed 14.6% to ₹5.13 lakh crore.

Meanwhile, Titan fell over 5% after it reported a 20% increase in overall consumer business for the first quarter of fiscal 2026.

Navin Fluorine rose 2% after launching a Qualified Institutional Placement (QIP) to raise upto ₹750 crore.

Nectar Lifesciences fell15% after the company announced its plans to sell the API and formulations businesses to Ceph Lifesciences for ₹1,270 crore.

And Siemens Energy rose 2% as Jefferies initiated coverage with a target price of ₹3,500.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal noted that the Nifty index needs to achieve a 15-minute close above 25,500 to trigger a potential move towards 25,570-25,620 levels, with immediate support near 25,390. If the index falls below this support, we could see short-term pressure till 25,320. He believes that the index is waiting for an announcement on the US-India trade deal before committing to a strong directional trend.

Analyst Vinayak Gautam highlighted that, despite the sideways movement, the overall bias and sentiment remained intact, with key near-term support holding firm in the 25,250–25,300 zone. A sustained breakout above the 25,650 level could trigger a renewed uptrend, potentially paving the way for higher targets at 25,700 and 26,200.

Analyst Varunkumar Patel observed that foreign institutional investors (FIIs) purchased over ₹300 crore in cash market shares but increased their net short positions in index futures and options. The global market sentiment is currently neutral with no signs of panic, but volatility is expected to rise, along with the VIX. He advised investing in strong stocks with a stop-loss in place.

Globally, Asian markets traded mixed, while crude oil prices eased as investors weigh new developments regarding U.S. tariffs and an OPEC+ output hike for August that exceeded expectations.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)