Advertisement|Remove ads.

Indian Markets Open Higher, Midcaps Muted; SEBI RAs Highlight Cautious Optimism

Indian markets opened marginally higher on Tuesday, tracking mixed global cues.

At 09:45 a.m. IST, the Nifty 50 traded 57 points higher at 25,574, while the Sensex was 208 points higher at 83,815.

Broader markets were subdued, with the Nifty Midcap and Smallcap indices trading flat.

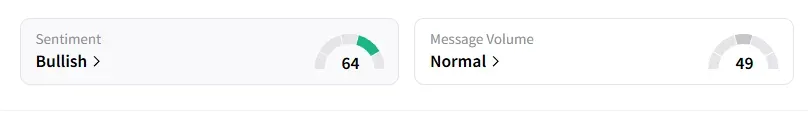

The retail sentiment on Stocktwits for Nifty remained ‘bullish’.

Sectorally, PSU banks, metals, pharmaceuticals, and consumer durables saw some selling pressure, while oil & gas, auto, and IT shares saw some gains.

Apollo Hospitals shares surged 5% to become the top Nifty gainer after its board approved a separate listing of its pharmacy and digital health businesses within 18-21 months, as part of a restructuring exercise. Citi maintained a ‘Buy’ with a target price of ₹8,260, indicating 15% upside.

BEL shares rose 3% after the defence company won fresh orders worth more than ₹500 crore. Kalpataru Projects gained 3% on winning new orders worth ₹989 crore.

Bajaj Auto shares fell 0.5% due to a subdued sales performance in June. Auto stocks will be in focus on Tuesday as they report sales data.

HCL Tech shares gained 1% after they announced a multi-year partnership with OpenAI.

Raymond shares continued to rise for the second session, gaining 7% ahead of its realty arm’s listing today.

Gabriel India's shares soared 20%, following the announcement of a business reorganization strategy aimed at simplifying the group's structure. It plans to merge Anand Group's auto & related business with itself via a share swap.

And Dixon Technologies fell 3% as Morgan Stanley downgraded it to ‘Underweight’ with a target price of ₹11,563, indicating 21% downside, citing execution challenges.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged immediate support for the Nifty at 25,470 and resistance at 25,720, while he placed Bank Nifty support at 57,100 and resistance at 57,800.

Sameer Pande pegged Nifty support between 25,450 and 25,200, with resistance at 25,800.

A&Y Market Research sees the Nifty intraday resistance between 25,648 and 25,662, and support between 25,308 and 25,322. For Bank Nifty, they peg resistance at 57,633-57,676 and support at 57,028-57,071.

Analyst Varunkumar Patel noted that Foreign Institutional Investors (FIIs) have sold over ₹800 crore in cash market stocks, while increasing their net short positions in index futures and options. Despite this, the overall market sentiment remains positive, with the US market driving the momentum.

He recommended staying bullish, focusing on small and mid-cap stocks for a sustained upward move, and investing in quality stocks with a stop-loss in place.

Globally, Asian markets traded mixed on Tuesday, while crude oil prices edged down on reduced tensions in the Middle East and the potential for an OPEC+ output increase in August.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)