Advertisement|Remove ads.

Indian Markets Open Lower As Banks, FMCG Drag; Nifty Slips Below 25,000

Indian equity markets opened lower on Tuesday, with the Nifty50 slipping below the psychological 25,000 mark in early trade.

At 9:40 a.m. IST, the Nifty 50 had fallen 185 points to 24,816, while the Sensex was down 664 points to 81,512.

Broader markets fare comparatively better, with the Nifty Midcap index flat and the Smallcap index up 0.3%.

Sectorally, except for pharma and real estate stocks, the rest of the indices trade in red. Banks, auto, FMCG and IT stocks witness selling pressure.

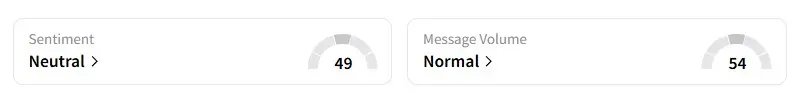

Meanwhile, the retail sentiment on Stocktwits has moved to ‘neutral’ from ‘bearish’.

Indigo fell over 2% after its co-founder Rakesh Gangwal reportedly sold up to 5.7% of his stake via a block deal at a floor price of ₹5,175/share.

Sagility India too fell over 5% as promoters look to offload up to 15.02% stake in the company via a two-day offer for sale (OFS)

Following a market regulator notice regarding the expiry days for derivative contracts, BSE shares fell nearly 2%. SEBI has mandated that the expiry dates for all equity derivative contracts across exchanges be standardized to either Tuesdays or Thursdays. Stock exchanges are required to submit their proposals to SEBI by June 15.

Among earnings-based movers, KEC International gained over 6% in early trade as investors cheered a strong March-quarter performance. Profit rose 76% to ₹268.20 crore

On the other hand, Bajaj Healthcare fell over 6% despite returning to profit in the fourth quarter.

And Brainbees Solution, the parent company of FirstCry, fell 3% after its losses widened to ₹111 crore in the March quarter.

Looking ahead, investors will monitor LIC, Bosch, Bharat Dynamics, NMDC, Hindustan Copper, RCF, among others, as they report quarterly numbers later in the day.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal notes that a breakout above the 25,050 level would likely open the path for Nifty to reach 25,190 or even higher as long as it remains above its immediate support.

For the short term, he identified 24,820 as a crucial support level, adding that only an hourly close below this threshold would warrant profit booking or a shift in trend.

For intraday trading, A&Y Market Research sees Nifty resistance levels at 25,187-25,238, while immediate support lies between 24,746-24,811.

In the case of Bank Nifty, resistance is pegged at 55,930-56,050, with support between 55,443-55,557.

Asian markets traded mixed as investors parse the trade tariff headlines and keep an eye on a flurry of economic data releases.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)