Advertisement|Remove ads.

Indian Markets Reverse Early Gains: Yes Bank, Adani, Vodafone Shares Under Pressure

Indian markets continue to consolidate. Benchmark indices witnessed a gap-up opening on Tuesday but soon reversed gains and traded lower.

Meanwhile, the Nifty Bank opened at a record high of 56,161, but gave up gains to trade 0.2% lower.

At 9:50 a.m. IST, the Nifty 50 had slipped 81 points to 24,635, while the Sensex was down 282 points to 81,091.

Broader markets continued their outperformance with the Nifty Midcap index gaining 0.4% and the Smallcap index rising 0.7%.

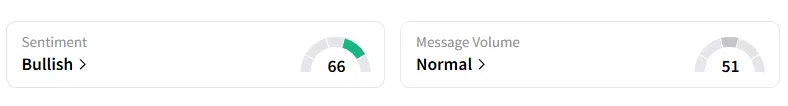

However, the retail sentiment on Stocktwits remained ‘bullish’.

Sectorally, private banks and select technology and FMCG shares witnessed selling pressure. Real estate, oil and gas, and metal stocks continue to shine.

Adani Enterprises and Adani Ports fell nearly 2% after the company denied a Wall Street Journal report alleging links with an Iranian LPG for imports, and a US Department of Justice probe into it.

Vodafone Idea fell over 1% as the debt-laden company resumed discussions with the government to explore a resolution over its dues.

Yes Bank’s shares fell over 7% on reports of 3% equity changing hands in multiple block deals. The board also meets today to discuss a fundraising proposal.

Ola Electric and Aptus cracked 8% while Zinka Logistics fell 2%, following large block deals.

Torrent Power gained 2% after signing a long-term supply pact with BP Singapore.

Frontier Springs rallied 9%, driven by ₹92 crore order win

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged immediate support for the Nifty at 24,580 and resistance at 24,920, while he placed Bank Nifty support at 55,500 and resistance at 56,400.

Ashish Kyal believes that on a 15-minute chart, a close above 24,800 will likely trigger a positive move to 24,890, followed by 24,950. However, prices must hold on the downside at 24,590 to maintain this bullish outlook.

Indicators suggest that momentum is due to emerge, which can lead to a potential breakout for the Nifty, which has consolidated for the past 12 days.

Analyst Kush Ghodasara identified 55,320 as a key support level for the Nifty Bank. This level aligns with the 10-15-day moving average and can serve as a stop loss.

He also highlights the formation of an ascending triangle pattern, and a breakout from this indicates a potential upside target above 57,800.

Asian markets traded higher as investors monitored trade talks between the U.S. and China regarding tariff relief. Crude oil extends gains.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)