Advertisement|Remove ads.

Nifty Slips In Early Trade: SEBI RA Pegs Support At 24,290 As Border Tensions Loom

Indian benchmark indices slipped into the red in early trade on Thursday, with rising border tensions with Pakistan weighing on investor sentiment.

Traders are also eyeing weekly futures and options (F&O) expiry cues, while foreign fund inflows remain steady for the 15th straight session.

Around 9:45 am IST, the Nifty 50 dipped below the 24,400 mark and the Sensex hovered at 80,702. Despite the headline indices trading with minor losses, broader markets held firm in the green.

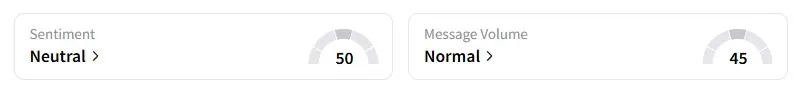

Data on Stocktwits showed retail sentiment for the Nifty 50 remained 'neutral.'

Sector-wise, FMCG, metal, pharma, and realty stocks were under pressure.

Among individual movers, Coal India became the top Nifty gainer with a 3% increase after posting a 12% YoY jump in Q4 net profit to ₹9,593 crore, driven by higher e-auction premiums and lower staff costs.

Tata Motors shares rose by over 3%, following reports of a possible trade agreement between the U.S. and the UK. This gain comes after a surge of over 5% on Wednesday for the passenger and commercial vehicle manufacturer.

Voltas gained 2% after Q4 net profit more than doubled to ₹241 crore, up 108% YoY.

Electronics and home appliances firm Symphony's shares surged by more than 11% following a robust performance in the March quarter. The company reported a 64.6% year-on-year increase in net profit.

On the other hand, consumer goods giant Dabur's fourth-quarter earnings disappointed, leading to a 1% stock fall. Profit decreased by 8.35% due to weak demand, while the company forecast high-single digit sales growth for FY26.

KFin Technologies surged 4%, following a report that private equity firm General Atlantic is looking to sell 6% stake in the fintech company.

Investors will monitor L&T, Titan, Asian Paints, Britannia, Bharat Forge, Biocon, Union Bank of India as they report quarterly numbers later in the day.

SEBI-registered analyst Prabhat Mittal highlights the current support and resistance levels for Nifty and Bank Nifty.

According to him, the Nifty currently has support at 24,290 and resistance at 24,510.

For Bank Nifty, he pegs support at 54,200 and resistance at 55,100.

Globally, Asian markets traded in the green, while Dow Futures stayed flat after the U.S. Federal Reserve held interest rates steady. Investors are also monitoring developments in the upcoming U.S.-China trade talks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)