Advertisement|Remove ads.

Nike Stock Pops After Hours As Apple’s Tim Cook Buys Nearly $3M In Shares Amid Turnaround Effort

- The purchase was disclosed in a regulatory filing showing an open-market buy by a long-tenured board member.

- The move came shortly after Nike reported earnings that topped expectations but carried a cautious holiday outlook.

- Nike continues to face pressure from higher tariffs and weaker demand in China.

Shares of Nike, Inc. (NKE) rose 0.7% in after-hours trading on Tuesday after a regulatory filing showed that board member Tim Cook made a nearly $3 million open-market purchase of the company’s stock, a move that comes as the sportswear company works through one of the most significant turnarounds in its recent history.

Nike said Cook bought 50,000 shares of Class B common stock on Monday at a weighted average price of $58.97, for a total value of about $2.95 million. Following the transaction, Cook directly owned 105,480 shares, according to the filing.

Cook’s Longstanding Board Role

Cook is the longest-serving member of Nike’s board of directors, having joined in 2005. He is Nike’s lead independent director and chair of the board’s compensation committee. He has been closely involved with the company’s major strategic decisions over the past two decades, including the company’s leadership transitions, technology partnerships and its challenges in the Chinese market, according to a Bloomberg report.

Cook was involved in advising the board during the leadership shake-up that saw former CEO John Donahoe step down after four years in the role. He later helped support the appointment of Elliott Hill, a Nike veteran who returned from retirement to lead the company, as it embarked on a multi-year turnaround.

Hill has said Nike is still in the “middle innings” of its recovery, with progress uneven across regions. North America has begun to stabilize, while China remains a pressure point amid weaker consumer demand and rising competition.

Strong Quarter Tempered By Holiday Outlook

The insider buy follows Nike's earnings report, in which the company delivered a quarter that topped Wall Street estimates. The results came with a warning from Nike that it still sees lower single-digit revenue declines on a constant currency basis for the holiday period, while higher U.S. tariffs continued to weigh on the company.

Nike has estimated $1.5 billion of annualized incremental product costs as a result of tariffs, which impacted margins in the most recent quarter.

Nike and Apple also maintain a long-standing commercial partnership, including co-branded Apple Watch models and fitness integrations, reinforcing Cook’s close operational familiarity with the brand.

How Did Stocktwits Users React?

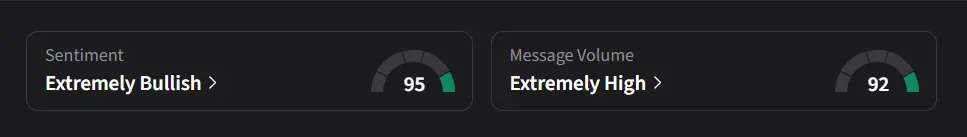

On Stocktwits, retail sentiment for Nike was ‘extremely bullish’ amid ‘extremely high’ message volume.

One bullish user said, “I just wish Tim Apple bought more than 3 million dollars.”

Another user suggested the buying may not be finished, speculating that Cook could add to his position again after the initial purchase.

Nike’s stock has risen 0.2% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)