Advertisement|Remove ads.

Nike Stock Rises Premarket: Goldman Sachs Stays ‘Constructive’ As Q1 Earnings Day Approaches

Nike shares rose 0.5% in early premarket trading on Friday, following a 2.8% drop in the previous session, and were on course for their fifth straight week in the red. However, a major Wall Street research firm maintained its "constructive" view on the stock as the company gears up to report financial results.

Goldman Sachs reiterated its 'Buy' rating and $85 price target on Nike shares on Thursday. The investment research firm believes the business is improving sequentially, and emerging green shoots in sport and strategic priorities such as performance running and women's apparel.

The sportswear giant is scheduled to report its fiscal first-quarter results next week on Tuesday. Analysts expect Nike to report a 5.2% drop in Q1 sales, the lowest since the May quarter of 2024, according to Koyfin data.

Adjusted EPS is expected to decline 61.5% to $0.27, although this would represent an improvement over the $0.14 EPS reported in the sequentially prior quarter.

The quarterly report marks another test for CEO Elliott Hill as he approaches his one-year anniversary at the helm.

Since taking over in October last year, Hill has shaken up the management and refocused product development towards sports customers, after years of the company gravitating towards lifestyle products under the previous CEO. Investors will look for material signs of improvement.

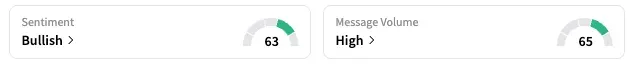

On Stocktwits, the retail sentiment for NKE was 'bullish' as of early Friday. Users were discussing the just-released NikeSKIMS women's activewear collection alongside earnings predictions.

NKE stock is down 9.2% year-to-date. Earlier this week, Morgan Stanley reiterated its 'Overweight' rating and $79.20 price target on NKE.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)