Advertisement|Remove ads.

Niva Bupa Shares Near Breakout: Wait For ₹92 Breach Or Dip To ₹78, Says SEBI RA Prameela B

Niva Bupa shares surged nearly 10% on Thursday, reaching a four-month high, after the health insurance company reported strong March-quarter results that exceeded market expectations.

The rally was driven by a 31.2% year-on-year jump in net profit to ₹206 crore and a 36% increase in gross written premium for the quarter, reflecting robust business growth and improved operational efficiency.

Niva Bupa has risen 25% in the last one month, on the back of renewed investor interest in the insurance space and broader market optimism toward defensive plays.

However, technical indicators now suggest the stock is at a make-or-break level.

SEBI-registered analyst Prameela Balakkala notes that while momentum was strong earlier this week, the Relative Strength Index (RSI) has cooled from a high of 74 to around 64, indicating waning buying pressure.

This moderation in RSI, coupled with declining volumes, points to caution among bulls.

“Traders should watch for a strong breakout above ₹92,” Balakkala advises.

A decisive move above this resistance zone could open the gates for an upward move towards ₹103 and ₹108 in the short term.

On the flip side, if the stock fails to breach ₹92 convincingly, a healthy retracement to the ₹78–₹80 range — near the 21-day Exponential Moving Average — could present a lower-risk buying opportunity for positional traders.

Balakkala emphasises that timing is key: “Wait for either a clean breakout or a meaningful dip near support for strategic entry.”

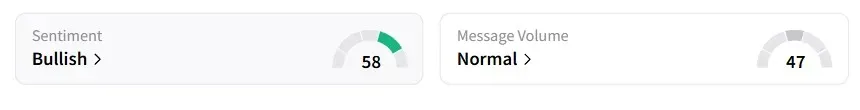

Data on Stocktwits shows that retail sentiment flipped to ‘extremely bullish’ from ‘bearish’ a week ago.

Niva Bupa shares gained 5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)