Advertisement|Remove ads.

Norwegian Cruise Line Adjusts Yield Outlook Amid Family Booking Push

- For fiscal year 2025, fuel costs are expected to rise 75 basis points.

- For Q4, Norwegian Cruise Line sees a net yield growth of approximately 3.5% to 4%.

- In Q3, the company's revenue of $2.9 billion fell short of the analysts’ consensus estimate.

Norwegian Cruise Line Holdings (NCLH) Executive Vice President and Chief Financial Officer, Mark Kempa, said the company expects slightly slower yield growth in the fourth quarter (Q4) due to its strategy focused on attracting more families aboard its ships.

During the third-quarter earnings call, Kempa stated that the cruise line operator anticipates Q4 net yield growth of approximately 3.5% to 4%.

Balancing Family Demand With Pricing Strategy

The move, while modestly reducing average ticket prices, aims to expand occupancy and passenger count by including additional guests per cabin, Kempa added.

“As a result of this dynamic in the fourth quarter, we expect net yield to grow approximately 3.5% to 4% reflecting our deliberate decision to welcome more families while taking a slight trade-off on price, which remains healthy at nearly 3% growth.”

-Mark Kempa, Executive Vice President and CFO, Norwegian Cruise Line Holdings

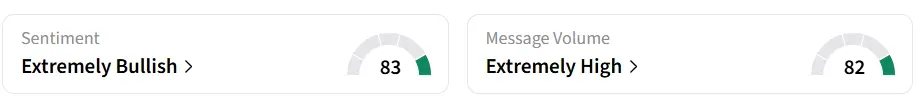

Norwegian Cruise Line’s stock traded over 14% on Tuesday afternoon and was among the top three trending equity tickers on Stocktwits. Retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Managing Costs And Debt

Adjusted net cruise costs excluding fuel are projected to remain nearly flat in Q4. For the full year, costs are expected to rise 75 basis points, which Kempa emphasized is still well below inflation levels.

Norwegian’s leverage ratio increased slightly to 5.4 times in Q3, up from 5.3 times in the previous quarter. The change was attributed to the delivery of the new Oceania Allura ship, which added to debt obligations.

In Q3, the company's revenue of $2.9 billion fell short of the analysts’ consensus estimate of $3.02 billion, and adjusted earnings per share (EPS) of $1.20 exceeded the estimate of $1.16, according to Fiscal AI data.

Norwegian Cruise Line's stock has lost over 26% year-to-date.

Also See: Shopify President Bets Big On AI For Holiday Season Sales

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)