Advertisement|Remove ads.

US Strikes Venezuela As Trump Claims President Maduro Capture, Crypto Markets Don’t Flinch

- Venezuela accused the U.S. of attacking residential areas in Caracas, while regional leaders called for restraint despite limited details.

- Bitcoin held near $89,000 and major altcoins gained despite the escalation.

- Polymarket prediction markets showed increased uncertainty, with odds fluctuating on U.S. military involvement and Venezuelan leadership change timelines.

Early Saturday, U.S. military helicopters hit key locations in Caracas, Venezuela's capital, including areas near the Fuerte Tiuna army base. Reports of explosions and power outages spread across parts of the city.

Donald J. Trump wrote on social media that the U.S. had carried out a "large-scale strike" against Venezuela. He also said that President Nicolás Maduro and his wife had been captured and flown out of the country in an operation that involved U.S. law enforcement. Trump said that more information would be given at a news conference at Mar-a-Lago at 11 a.m. ET.

Venezuela's government called the strikes an act of aggression and blamed Washington for trying to take control of the country's oil resources. Colombia's President Gustavo Petro and Cuba's President Miguel Díaz-Canel, among others, called for international help and restraint, but there were still no clear reports of casualties or the full extent of the operation.

Venezuela said that the US hit residential areas in a series of strikes early on Saturday and sent a lot of military resources to the area.

Venezuelan Defense Minister Vladimir Padrino Lopez said in a video statement shared on social media that the "invading" US forces have desecrated our land by attacking civilian areas with missiles and rockets fired from their combat helicopters.

How Crypto Markets Are Reacting

Despite the sharp geopolitical turmoil, crypto markets remained in the green. Bitcoin (BTC) hovered around $89,000. On Stocktwits, Bitcoin was trending at "number 1", as retail sentiment changed from ’bearish’ to ‘neutral’ territory. Chatter around the coin also improved from ‘low’ levels to ‘normal’ levels over the past day. On the other hand, major tokens like Ethereum (ETH), Ripple's XRP (XRP), and Solana (SOL) all saw gains.

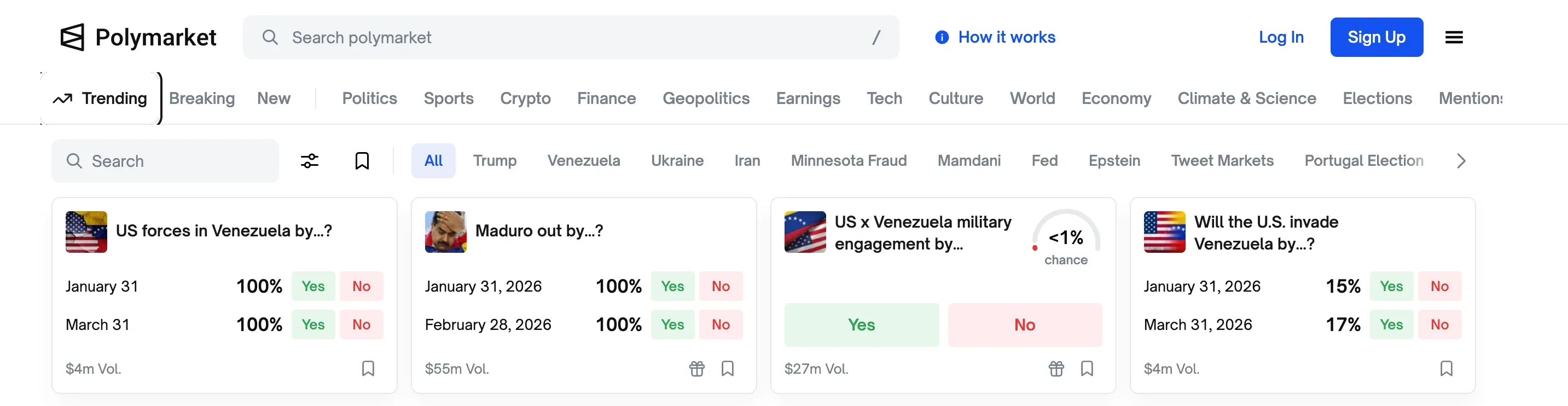

Prediction markets similarly showed increased uncertainty about the situation. On Polymarket, traders quickly moved their positions tied to Venezuela-related outcomes after Trump’s statement. Markets gauging whether U.S. troops would be involved in Venezuela, or whether Maduro would lose power by just before 2026, gyrated sharply, with some contracts factoring nearly a guarantee of changeover dates and others still assigning less likely odds for longer-term U.S. military action.

Historically, research shows that cryptocurrency markets reacted poorly when the war began, with liquidity and returns declining as severity of the war intensified. One peer-reviewed study shows that as war intensified, it hurt liquidity in the crypto markets. However, trading occasionally picked up afterward as markets adjusted.

Read also: Bitcoin Turns 17 As Spot ETFs Suffer Historic Losses

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)