Advertisement|Remove ads.

Nu Holdings, Neonode, Trade Desk Stocks Hit New 52-Week Highs — But Retail Bulls Focus On Just Two

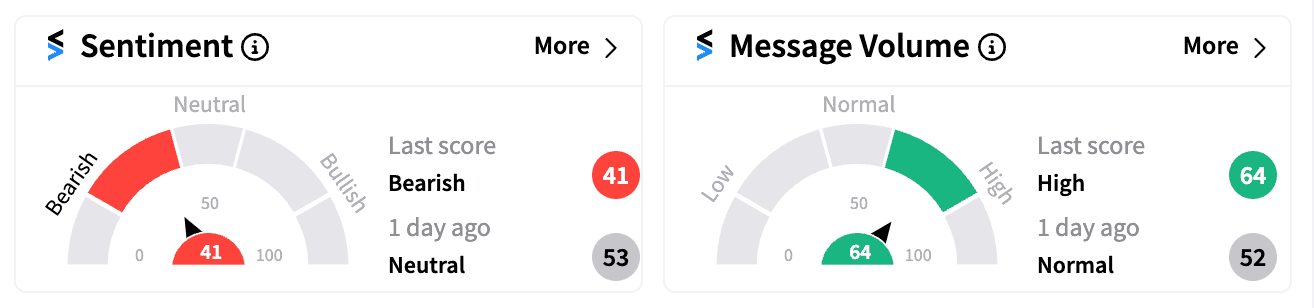

Shares of Nu Holdings Ltd. (NU), Neonode Inc. (NEON), and The Trade Desk Inc. (TTD) all reached fresh 52-week highs on Wednesday, marking a notable day for these three companies. However, retail investor sentiment on Stocktwits suggests that the excitement isn’t evenly spread.

Shares of Nu Holdings, the parent of Nubank — the most valuable bank in Latin America — have enjoyed a stellar year so far, climbing 83%.

Its second-quarter results in August showed net income more than doubled to $487 million, though revenue missed expectations.

Analysts have been mostly upbeat, with Barclays raising its price target on the stock to $17 from $15, and BofA also increasing its target.

However, retail sentiment took a hit, turning ‘bearish’ on Wednesday.

Notably, earlier this month, a Bloomberg report pointed to rising bad loans for the company.

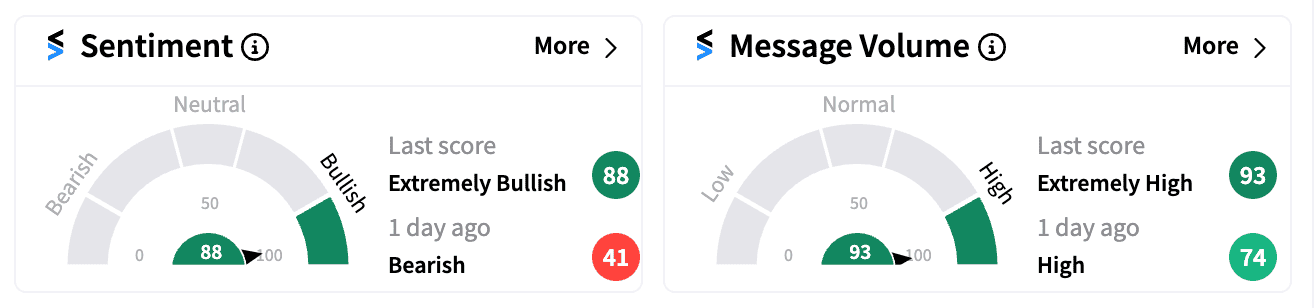

Neonode, on the other hand, surged by as much as 17% on Wednesday with trading getting temporarily halted earlier in the day due to volatility.

Retail investors showed strong enthusiasm, with sentiment turning ‘extremely bullish’ as the stock continues its stunning 463% rise this year.

Neonode, a leader in touchless interaction and infrared touch technology, has been successfully shifting its business model towards licensing.

Its first major licensing deal with YesAR, a Chinese holographic display firm, and its continued progress in driver monitoring systems are seen as significant growth drivers.

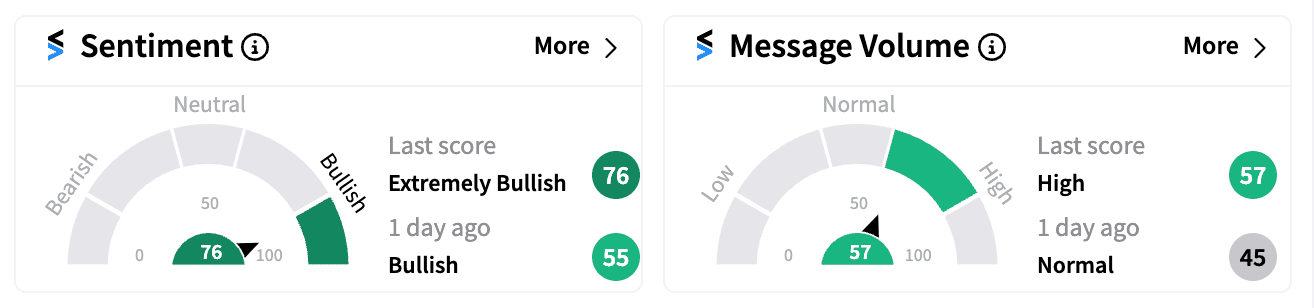

Lastly, The Trade Desk shares rose more modestly, but retail sentiment edged higher into the ‘extremely bullish’ zone.

The ad tech giant has gained over 50% this year, with the rally coming on the back of strong quarterly results and amid important ongoing developments.

Rival Alphabet Inc.’s Google faces a historic U.S. antitrust trial over its alleged monopoly on the digital ad market. The Trade Desk CEO Jeff Green has also been vocal about the need to break up Google’s ad tech dominance

Analysts have been optimistic, with Wedbush raising its price target to $115 from $110 on the stock, expecting significant growth in political ad spending on connected TV (CTV) platforms ahead of the 2024 U.S. elections.

Read next: MannKind Stock’s Rise Draws Retail Attention As Japan Clears Phase 3 Study of Lung Disease Drug

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)