Advertisement|Remove ads.

MannKind Stock’s Rise Draws Retail Attention As Japan Clears Phase 3 Study of Lung Disease Drug

MannKind Corp. (MNKD) shares rose on Wednesday and gained significant retail investor interest after the company said that Japan’s medical regulator has granted approval to start its Phase 3 study (ICoN-1) for Clofazimine Inhalation Suspension, which targets the treatment of nontuberculous mycobacterial (NTM) lung disease.

With this clearance, the global study is now set to proceed in Japan, the U.S., South Korea, and Australia, with Taiwan expected to join by the fourth quarter of 2024.

The trial, which began in the U.S. in June 2024, has already randomized its first patient and aims to enroll around 230 participants worldwide.

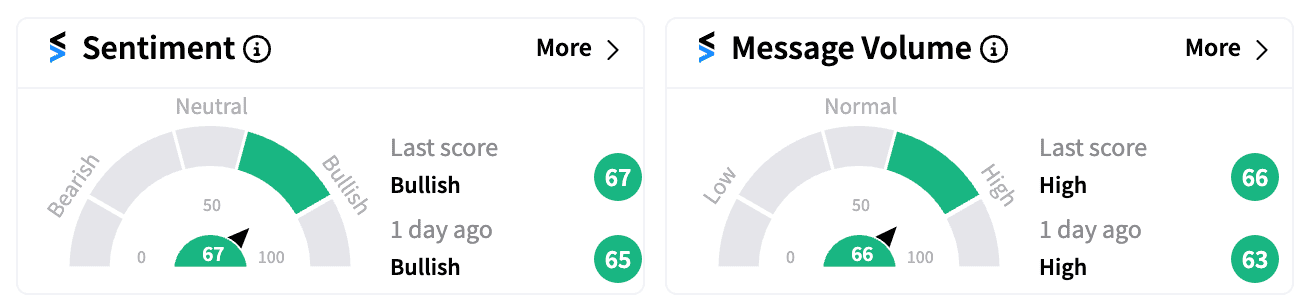

Before the bell on Wednesday, MNKD was among the top 5 trending tickers on Stocktwits, with retail sentiment turning increasingly 'bullish'.

One user shared, “This is the beginning of the ride I always expected… So much to come.”

Another noted the potential for MannKind to dominate the NTM market, which is reportedly projected to reach $1 billion by the end of the decade, assuming proven efficacy in the ongoing trial.

MannKind’s momentum is also bolstered by its royalty stream from United Therapeutics’ Tyvaso DPI, a treatment for pulmonary arterial hypertension and interstitial lung disease.

Under a 2018 agreement, MannKind receives a 10% royalty on sales of Tyvaso DPI, which hit the market in 2022 following FDA approval.

Analysts see long-term value in this deal, with Oppenheimer forecasting additional royalties from the drug’s use in treating idiopathic pulmonary fibrosis (IPF), which could add $5 billion in peak sales by 2033.

Leerink also recently raised its price target on MNKD to $8, citing its robust royalty stream and promising pipeline of inhaled therapies for orphan lung diseases.

Additionally, Oppenheimer increased its target to $12, pointing to MannKind’s continued growth potential.

MNKD stock has surged more than 65% year-to-date, driven by optimism around its innovative therapies and expanding revenue streams.

Read next: Nvidia Stock Rated ‘Outperform’ By William Blair: Retail On The Fence For Now

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)