Advertisement|Remove ads.

Novavax Retail Traders Stay Bullish Ahead Of Q4 Print Even As RFK Jr's HHS Leadership Causes Ripples

Novavax Inc. shares climbed 2% on Wednesday and extended gains in after-hours trading, as retail investors maintained a bullish stance hours ahead of the company's fourth-quarter earnings report.

Analysts expect a narrower loss compared to the prior year, though revenue is anticipated to decline sharply, while concerns over U.S. vaccine policy under Health and Human Services Secretary Robert F. Kennedy Jr. continue to add uncertainty.

The company is projected to report an adjusted loss of $0.51 per share for Q4, a notable improvement from the $1.44 loss recorded a year ago. However, revenue is expected to drop more than 70% to $84.38 million.

Last year, Novavax suffered a temporary setback when the FDA placed its COVID-19 and flu combination vaccine (CIC) on clinical hold due to safety concerns. The company also lowered its full-year revenue guidance, tempering investor optimism.

However, Novavax secured a $50 million payment from its partnership with Sanofi in December for progress on a COVID-19 vaccine for children.

Novavax also stands to receive $200 million for the first four Sanofi products utilizing its Matrix-M adjuvant, with an additional $210 million per product thereafter.

Investors are also closely monitoring developments in Novavax's bird flu vaccine efforts as rising U.S. cases heighten public health concerns.

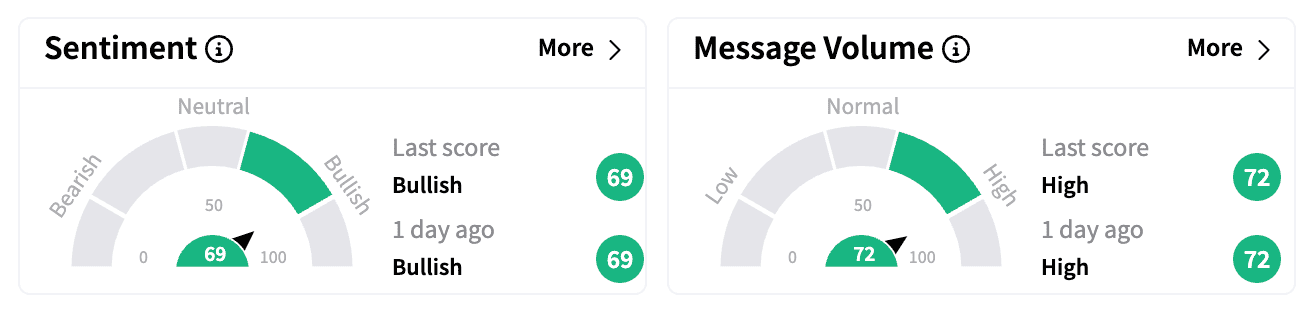

Retail traders on Stocktwits remained optimistic, with sentiment remaining 'bullish' and message volume surging.

One user laid out a "home run" Q4 scenario: a combination of strong earnings, regulatory approvals, and new partnerships.

In November, Novavax stated that its Biologics License Application (BLA) for its COVID-19 vaccine under the Prescription Drug User Fee Act (PDUFA) has an action date of April 2025. Achieving BLA approval would trigger a $175 million milestone payment from Sanofi.

Others dismissed concerns about Kennedy's influence over vaccine policy, arguing that political checks and balances would limit drastic shifts.

The debate was fueled by a Bloomberg report indicating that U.S. health officials are reconsidering a $590 million contract awarded to Moderna for bird flu vaccines, raising speculation about broader regulatory changes.

Additionally, CNBC reported that the FDA has canceled a key March vaccine advisory meeting without explanation.

Kennedy, a longtime vaccine skeptic, now oversees HHS decisions that could impact vaccine makers, making his leadership a wild card for Novavax.

The company's stock is down nearly 10% year-to-date but has gained over 30% in the past 12 months. According to Koyfin data, short interest remains elevated at 21.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261087084_jpg_9cdd1d104f.webp)