Advertisement|Remove ads.

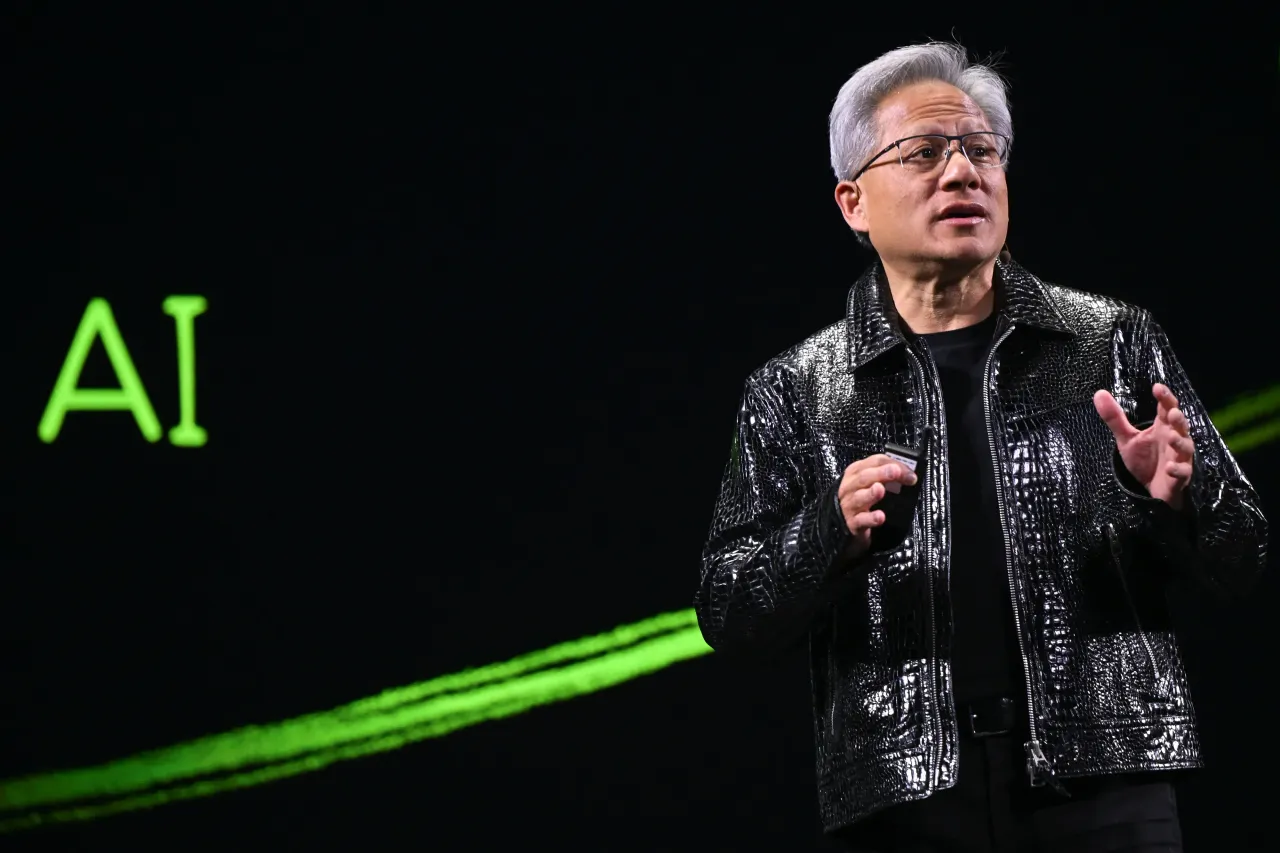

NVDA Shares Surge As Huang Says Demand For AI Is ‘Sky High’

- Huang also said that AI capital investments from tech hyperscalers is appropriate and sustainable, adding that the cash flows of the companies would rise in the future.

- He noted that the change in AI comes with an “inflection point” and “profitable tokens” for companies involved.

- He also said that nobody uses AI better than Meta, adding that the company’s earnings show for it.

Shares of Nvidia Corp. (NVDA) surged over 7.5% on Friday after CEO Jensen Huang said that demand for artificial intelligence is “sky high,” adding that “we’re in a once-in-a-generation infrastructure buildout.”

“Artificial intelligence is going to fundamentally change how we compute everything,” Huang said in an interview with CNBC.

The chief of America’s largest chipmaker also said that in the past few years, AI has gone from being “curious to super useful,” finding use cases across the board.

Huang’s comments come amid growing spending from big technology firms on artificial intelligence infrastructure buildout.

AI Investments

America’s biggest tech companies have collectively announced their plans to invest over $630 billion in AI buildouts in 2026, a number that is more than the GDP of countries like Singapore or Israel, and is more than double the spend from 2025.

In its latest earnings, Amazon.com (AMZN) said it will allocate $200 billion to capital expenditure in the year, directed at AI investments. Meanwhile, Google parent Alphabet Inc. (GOOG, GOOGL) expects its capex for 2026 to be in the range of $175 billion to $185 billion. Meta Platforms Inc. (META) also increased its capex for 2026, announcing a range of $115 billion to $135 billion, up considerably from $72.22 billion clocked in 2025.

Huang said that the investments from these hyperscalers are appropriate and sustainable. “All of these companies’ cash flows are going to start rising. We are addressing the largest software opportunity in history,” he said.

The Nvidia CEO noted that the change in AI comes with an “inflection point” and “profitable tokens” for companies involved. He noted that companies like Anthropic and OpenAI are already profitable, adding that “if they could have twice as much compute, revenues could go up four times as much. These guys are so compute-constrained, and demand is so incredibly great.”

The Best AI User

“Nobody uses AI better than Meta,” Huang said in the interview, highlighting how the company uses AI now. He said that Meta went from a classic recommender system to a generative AI agentic system that’s now making relevant AI-based recommendations across social media, advertising, and content.

“And their earnings show it. They see a much larger future potential for it,” Huang added.

He also mentioned Amazon’s AWS recommendations and Microsoft’s enterprise business as those that will benefit from the AI buildout. “Everyone is going to see an inflection point, and that’s why they’re leaning in so hard,” he said.

Huang also said that there are several years of buildout ahead, about five to eight years before it peaks and then settles into requiring only refreshers.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment around NVDA shares remained ‘neutral’ in the past 24 hours amid ‘high’ message volumes.

Shares of NVDA have gained over 43% in the past year.

Shares of Broadcom Inc. (AVGO) surged over 7% on Friday amid growing AI infrastructure spends. The company has gained over 43% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: Dow Rallies Over 50,000 For The First Time, S&P 500 Edges Higher Amid Tech Revival

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)