Advertisement|Remove ads.

Nvidia Stock Faces Market Jitters Ahead Of Highly Anticipated Earnings Report: Retail In Wait-And-Watch Mode

Shares of Nvidia Corp. (NVDA) dipped over 2% on Wednesday afternoon, hours before the company’s Q2 earnings report after the bell.

As the leading player in the artificial intelligence boom, Nvidia’s upcoming results are seen as one of the most important earnings events of the season.

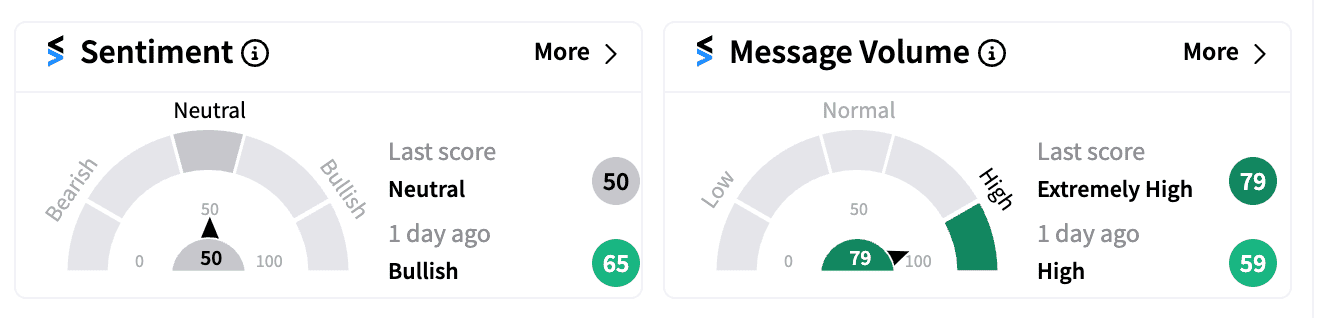

Retail interest in Nvidia has surged. On Stocktwits, message volumes for NVDA have skyrocketed over 1,300% in the past month, and the ticker now ranks as the fifth-most-watched symbol with nearly 531,000 followers.

Despite the growing buzz, retail sentiment for Nvidia remains balanced at ‘neutral’ (50/100), suggesting a mix of anticipation and caution among investors.

Nvidia has been on a remarkable growth streak, with revenue tripling annually in the past three quarters, largely driven by its data center business.

Wall Street expects a fourth consecutive quarter of triple-digit revenue growth, though at a slower pace of 112%, bringing revenue to $28.7 billion and EPS to $0.65.

Looking ahead to the October quarter, Nvidia’s forecast is also under the microscope, with projected revenue growth of about 75% to $31.7 billion.

Investors are keenly watching for updates on Nvidia’s next-generation AI chips, known as Blackwell, which was said to be facing production delays earlier this month. However, Nvidia maintains that production is still on track to ramp-up in the second half of the year.

Most analysts remain bullish on Nvidia despite these concerns. Truist raised its price target to $145 from $140, citing improving business trends and dismissing Blackwell delays as “supply chain noise.”

Loop Capital maintained a $175 target, noting that improved Hopper chip production may offset any impact from Blackwell delays. HSBC lifted its price target to $145, expecting Nvidia to beat both management guidance and consensus estimates. Evercore ISI increased its target to $150 and advised buying shares ahead of the Q2 report.

Retail investors are split on Nvidia’s outlook. Some are betting big on a post-earnings rally.

“I’m gambling $10k on earnings,” posted one user, viewing it as a “legendary earnings call.”

“$NVDA crashing. Way too expensive, it will miss on earnings. Expectations are too high,” cautioned another.

Nvidia, up nearly 160% this year, has faced recent pressure due to concerns over export restrictions of advanced semiconductors to China, and a rotation out of mega-cap tech stocks amid expectations of interest-rate cuts.

Worries about excessive spending on AI infrastructure have also affected some Big Tech stocks this earnings season.

According to Reuters, the options market suggests Nvidia’s earnings could trigger a significant move, potentially affecting over $300 billion in market value.

Don't forget to check out Stocktwits' NVDA Day prediction contest!

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)