Advertisement|Remove ads.

Nvidia Says Its 6-Year Old A100 Chips Are Running At Full Tilt, Countering Michael Burry’s Depreciation Warning

- The company’s CFO, Colette Kress, credited this to Nvidia’s CUDA platform.

- Nvidia launched the A100 GPU in 2020 based on the Ampere architecture.

- Earlier, Burry said that hyperscalers ramping up capital expenditure by purchasing Nvidia chips should not result in extending the useful lives of the chips they had already purchased.

Nvidia Corp. (NVDA) on Wednesday clarified that its A100 graphics processing units (GPUs) are still running at full utilization, six years after the company shipped them. This comes after ‘Big Short’ Michael Burry cast aspersions on hyperscalers’ policies regarding chip depreciation.

This comes after Nvidia reported blowout third-quarter (Q3) earnings that surpassed Wall Street expectations. Nvidia reported earnings per share (EPS) of $1.3 on revenue of $57 billion, compared to analyst estimates of an EPS of $1.26 on revenue of $54.62 billion, according to Stocktwits data.

Nvidia shares were up more than 5% in Thursday’s pre-market trade. Retail sentiment on Stocktwits around the company trended in the ‘extremely bullish’ territory at the time of writing.

What Nvidia Said

While addressing analysts during the company’s post-earnings call, Nvidia’s Executive Vice President and CFO, Colette Kress, detailed the state of the A100 chips shipped six years ago.

“Thanks to CUDA, the A100 GPUs we shipped six years ago are still running at full utilization today, powered by vastly improved software stack,” Kress said.

Nvidia launched the A100 GPU in 2020 based on the Ampere architecture. Its successors are the H100 and Blackwell chips, released in 2022 and 2024, respectively.

What Burry Said

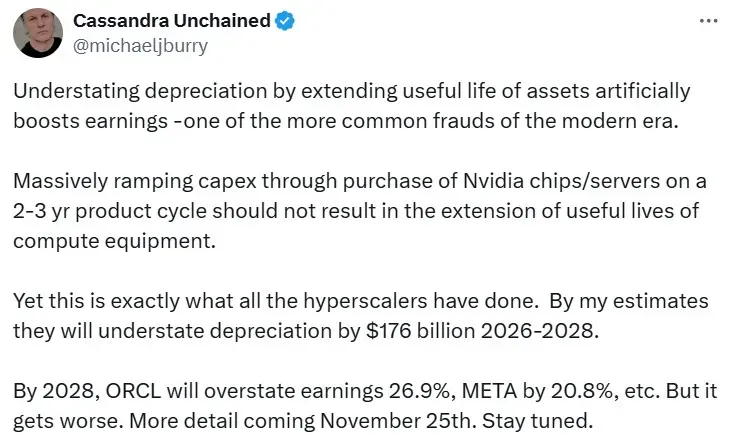

Earlier, Burry stated in a post on X that hyperscalers are “understating depreciation” of chips.

“Understating depreciation by extending useful life of assets artificially boosts earnings -one of the more common frauds of the modern era,” Burry said.

He added that hyperscalers ramping up capital expenditure by purchasing Nvidia chips should not result in extending the useful lives of the chips they had already purchased.

“Yet this is exactly what all the hyperscalers have done. By my estimates they will understate depreciation by $176 billion 2026-2028,” Burry added.

Huang Dismisses AI Bubble Concerns

Speaking to analysts post earnings, Nvidia CEO Jensen Huang dismissed talks of a bubble in the artificial intelligence sector.

“There has been a lot of talk about an AI bubble. From our vantage point, we see something very different,” he said. The Nvidia chief added that the demand for compute is growing exponentially. “Blackwell sales are off the charts, and cloud GPUs are sold out. We’ve entered the virtuous cycle of AI.”

NVDA stock is up 39% year-to-date and 27% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)