Advertisement|Remove ads.

Nvidia Is The “Foundational Piece” Of AI Revolution, Says Dan Ives Ahead Of Earnings

- Dan Ives projected that Nvidia will likely beat the Street estimates.

- Analysts expect Nvidia to post a Q3 revenue of $54.8 billion and EPS of $1.25.

- Ives said Asia's supply-chain checks and big capital expenditures as positives for AI.

Dan Ives, managing director at Wedbush Securities, has doubled down on his bullish stance on Nvidia, calling it one of the indisputable forces behind the AI revolution.

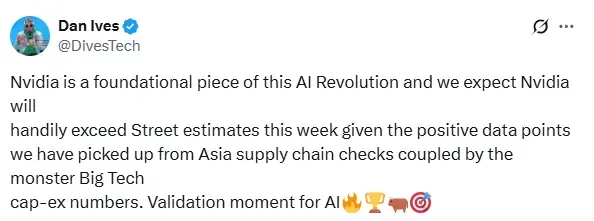

In a post on X, Ives expressed optimism about the AI bellwether’s upcoming earnings report, scheduled for November 19.

“Nvidia is a foundational piece of this AI Revolution and we expect Nvidia will

handily exceed Street estimates this week,” Ives said in the post.

Third-Quarter Expectation

According to Fiscal AI data, analysts expect Nvidia to post a Q3 revenue of $54.8 billion and earnings per share (EPS) of $1.25.

Ives, who leads technology research at Wedbush, says the combination of favorable supply-chain checks across Asia and “monster” cap-ex budgets from major tech firms validates his long-term bullish thesis on AI.

Nvidia’s stock traded over 1% lower in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Technology Pullback

Last week, Ives called the recent downturn in technology stocks temporary turbulence rather than a signal of lasting weakness.

With tech giants ramping up their capital expenditure to ramp up as much AI infrastructure as possible, investors have started to worry about valuations. However, analysts, including Fundstrat’s Mark Newton, have allayed fears, stating that despite declines across leading tech names, the broader sector remains intact and is positioned for a rebound.

During its late-August earnings call for the second quarter, Nvidia projected third-quarter revenue of nearly $54 billion, with a possible 2% swing either way.

NVDA stock has gained over 41% year-to-date and over 35% in the last 12 months.

Also See: Is Netflix Gearing Up For A Year-End Rally? Retail Traders Think So After The Stock Split

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)