Advertisement|Remove ads.

Nvidia’s Market Cap Crosses $4.5 Trillion As AI Momentum Gains Pace

Nvidia Corp’s (NVDA) market capitalization reached $4.5 trillion on Tuesday after the shares rose over 2% to hit an all-time high, fueled by aggressive AI-related deals and increasing investor confidence.

The stock is witnessing significant momentum as the company expands its role in artificial intelligence infrastructure through partnerships and investments.

On September 22, Nvidia announced its plans to invest $100 billion in OpenAI, agreeing to supply and finance at least 10 gigawatts of advanced computing systems for the ChatGPT maker’s next-generation models.

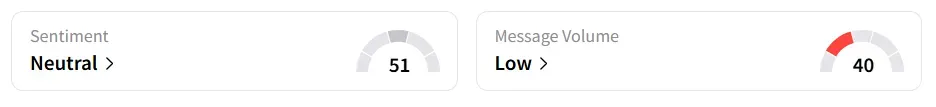

At the time of writing, Nvidia stock pared some of its gains and was trading over 1% higher. On Stocktwits, retail sentiment around Nvidia stock remained in ‘neutral’ territory amid ‘low’ message volume levels.

Nvidia is also making a $5 billion investment in Intel Corp. (INTC) stock, collaborating to co-develop multiple lines of data center and PC technologies, intending to advance AI, enterprise, and consumer applications.

The chip giant also received a boost from two major Wall Street firms on Tuesday, with both KeyBanc and Citi raising their price targets based on improving supply dynamics, product advancements, and AI demand.

KeyBanc lifted its target price on Nvidia shares to $250 from $230, maintaining an ‘Overweight’ rating, according to TheFly. Citi also revised its price target on the stock, increasing it to $210 from $200, while maintaining a ‘Buy’ rating and stating that it is ‘incrementally positive’ about the company’s product momentum.

Nvidia’s stock has gained over 39% year-to-date and over 54% in the last 12 months.

Also See: Firefly Aerospace’s Alpha Rocket Setback Draws Roth Capital’s Doubt, But Retail Goes Contrarian

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)