Advertisement|Remove ads.

Firefly Aerospace’s Alpha Rocket Setback Draws Roth Capital’s Doubt, But Retail Goes Contrarian

Firefly Aerospace Inc.’s (FLY) shares tumbled over 22% on Tuesday after its Alpha Flight 7 rocket exploded in a pre-flight test. The development has prompted Roth Capital to trim its price target on the stock to $40, down from $60.

“During testing at Firefly’s facility in Briggs, Texas, the first stage of Firefly’s Alpha Flight 7 rocket experienced an event that resulted in a loss of the stage. Proper safety protocols were followed, and all personnel are safe,” Firefly said in a statement on Monday.

Roth Capital concluded that the rocket's initial stage was likely lost during pre-launch testing, raising concerns about scheduling for upcoming missions.

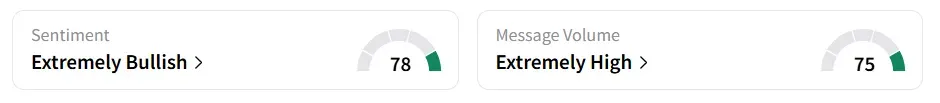

However, on Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

A bullish Stocktwits trader said this was a good opportunity to buy the stock.

Although Roth noted that no major revenue was expected from the FLTA0007 mission, the delay could ripple into the broader launch timeline for Firefly’s next mission, FLTA0008, originally set for this year.

Firefly's Alpha rocket experienced a failed launch in April after a malfunction during the flight led to a Lockheed Martin satellite crashing into the Pacific Ocean. The company received clearance from the U.S. Federal Aviation Administration to restart its launches just last month.

For the second quarter (Q2), the company’s revenue of $15.5 million and loss per share (EPS) of $5.78 both missed the analysts’ consensus estimate of $27.84 million and a loss per share of $0.41, according to Fiscal AI data.

Since its listing in August, Firefly Aerospace stock has lost over 52% in value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)